Pennsylvania Secretary of State Business Search

If you're starting a business in Pennsylvania, conducting a Secretary of State Business Search is a vital first step. Learn how to do it right with BrandSnag!

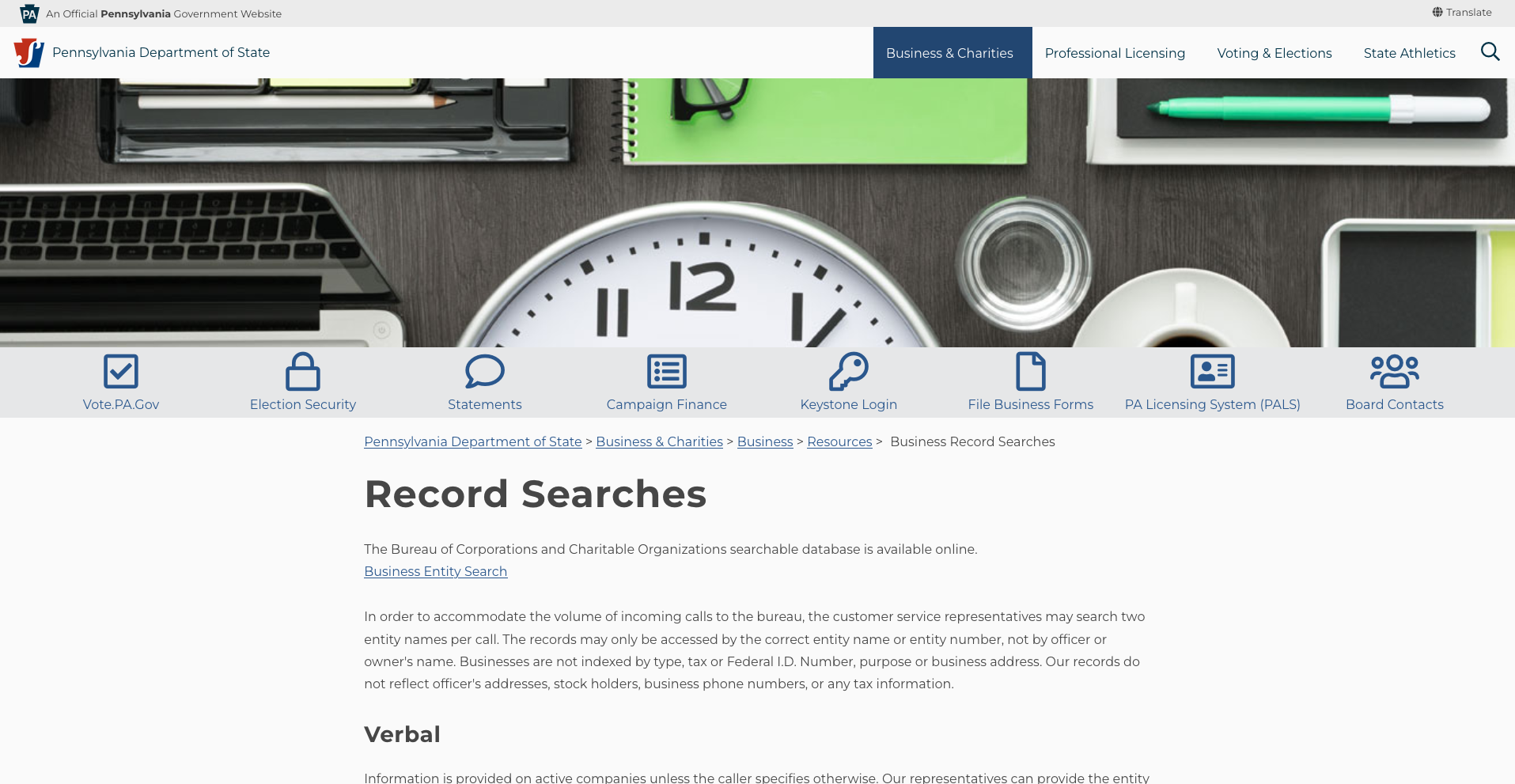

Accessing the Search Platform

The first step in conducting a business search is to access the Pennsylvania Department of State's Business Search page. This online platform is designed to be user-friendly, allowing for quick and easy searches of business entities. The page can be accessed here.

Conducting the Search

Step 1: Entering Business Name or Entity Number

The search process begins with entering the business name or an 8-digit entity number into the search bar. This can be the full name or a partial one, depending on the information available.

Step 2: Refining Search Criteria

Users have the option to refine their search using various criteria. One can filter results to show only active entities or use specific search types like "Starting With" or "Exact Match" for more precise results.

Step 3: Initiating the Search

After entering the desired parameters, clicking the "Search" button will initiate the process, leading to a display of matching business entities.

Step 4: Analyzing Search Results

The search results provide a list of businesses matching the query. Each listing includes basic details like the business name or entity number. For more in-depth information, clicking on a specific business is necessary.

Utilizing Search Tips for Effective Results

To maximize the effectiveness of the search, certain strategies can be employed:

- Using keywords instead of full names broadens the search.

- Experimenting with different name spellings and variations can uncover more results.

- Incorporating both uppercase and lowercase letters in the search can yield different results.

- Excluding business entity designations such as Inc, LLC, and Corp helps in a broader search.

- Including dissolved and inactive entities in the search can be useful for checking name availability.

Exploring the Range of Information Available

The Pennsylvania business entity search provides extensive details on registered businesses. This includes:

- Business name and entity number.

- The type of business entity, such as LLC or corporation.

- Current status (active, inactive, dissolved, etc.).

- Date of original filing.

- Registered office address and principal place of business.

- Key individuals like officers, directors, partners, and members.

- Fictitious names associated with the business.

- Merger history.

- History of annual report filings.

- Availability of certificates of good standing.

- Access to filed documents like articles of incorporation or organization, bylaws, etc.

Advantages of the Pennsylvania Business Search

This search tool is particularly beneficial for new business owners and entrepreneurs. It assists in determining if a desired business name is available, provides insights into competitors, and offers a wealth of information on any registered business. Additionally, it's a free resource, with certain documents available for purchase.

How to Set Up a Business in Pennsylvania

Choosing a Business Structure

Selecting the right business structure is a fundamental step in establishing a business in Pennsylvania. The state recognizes various forms, each with its own implications for liability, taxation, and management.

- Sole Proprietorship: This simplest form involves a single individual owning the business. It doesn't require formal state filing.

- General Partnership: Similar to a sole proprietorship but owned by two or more individuals, this structure also does not necessitate formal filing.

- Limited Partnership (LP): Involving at least one general and one limited partner, this structure mandates filing a Certificate of Limited Partnership.

- Limited Liability Company (LLC): This popular option offers a blend of partnership and corporation characteristics, requiring the filing of Articles of Organization.

- C Corporation: As a distinct legal entity, it necessitates filing Articles of Incorporation and offers ownership through shareholders.

- S Corporation: This option allows corporations to be taxed similarly to partnerships, subject to certain criteria, and also requires filing Articles of Incorporation.

Registering Your Business

- To secure your business name, check its availability via the Pennsylvania Department of State database and reserve it.

- Organizational documents for LLCs, corporations, and LPs must be filed with the Pennsylvania Department of State.

- For sole proprietorships and partnerships, registering a fictitious business name is necessary if operating under a name different from the owner's legal name.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

Acquiring Licenses and Permits

- Register for a Sales Tax License if selling taxable goods or services, accomplished through the PA-100 form.

- Investigate and obtain any required state or local permits and licenses, many of which are also available through the PA-100 process.

- Certain professions may require specific occupational licenses.

Compliance with Regulations

- Adhere to all legal and regulatory requirements at federal, state, and local levels.

- Seeking advice from a business lawyer or Small Business Administration (SBA) representative can provide valuable guidance.

- Maintain accurate and up-to-date business records and registers.

Managing Taxes

- Fulfill all relevant federal, state, and local tax obligations.

- Sole proprietors report their business income through personal tax returns.

- Income from partnerships and S-Corporations is passed through to the owners for taxation.

- C-Corporations are taxed at the entity level.

Concluding Thoughts

In summary, the Pennsylvania business entity search is an essential tool for anyone involved in the business sector within the state. It provides valuable insights into business registrations, legal statuses, and key company information. With the steps outlined above, conducting a comprehensive search is straightforward and accessible.

Related Business Search Articles

- Wisconsin Corporation Search

- Louisiana Business Entity Search

- North Carolina (NC) Secretary of State Corporation Search

- Utah Business Entity Search

- How to Conduct an Illinois Business Search

- How to Conduct a Delaware Business Entity Search

- Nevada SOS Business Search

- Florida Business Entity Search: FL SOS & SunBiz Search Guide

- How to Conduct an Oregon Business Search

- How to Conduct a Maryland Business Search

- How to Conduct an Idaho Business Entity Search

- CT Business Lookup: Search for a Business in Connecticut

- Conduct a Minnesota SOS Business Search

- New Jersey Secretary of State Business Search

- Texas Secretary of State Business Search (SOS)

- Michigan Business Entity Search

- New York Secretary of State Business Search (NY SOS)

- Arkansas Secretary of State Business Search

- Colorado Business Entity Search

- Massachusetts Business Entity Search

- Oklahoma Secretary of State Business Search

- New Hampshire (NH) Business Entity Search & Lookup

- Kansas Business Entity Search (KS SOS)

- Pennsylvania Secretary of State Business Search