How to Conduct an Oregon Business Search

Conducting an Oregon business search can be overwhelming, but our step-by-step guide breaks down the process into simple, easy-to-follow steps!

To establish a business in Oregon, it is important to register with the state and make sure your business name is unique. The easiest way to do this is by conducting an Oregon business search.

Conducting a business search in Oregon is relatively easy through Oregon's SOS website, which allows you to search for a business name, check the availability of a business name, and also see if a given business is registered with the state.

So, this article is for potential business owners looking to establish or expand their business in Oregon. Here are the steps you need to follow when conducting an Oregon business search.

How to Conduct an Oregon Business Entity Search (SOS Search)

There are a few simple steps to take to conduct a business entity search in Oregon:

Visit the Oregon Secretary of State's Website

Every state in the USA has a website dedicated to its Secretary of State -and Oregon is no different. To begin your business search, visit the Oregon SOS website at http://www.oregon.gov/sos/.

Search for Business Names

Once on the homepage, you will find the 'Oregon Business Name Search' section on the left of the page.

Check for Available Business Names

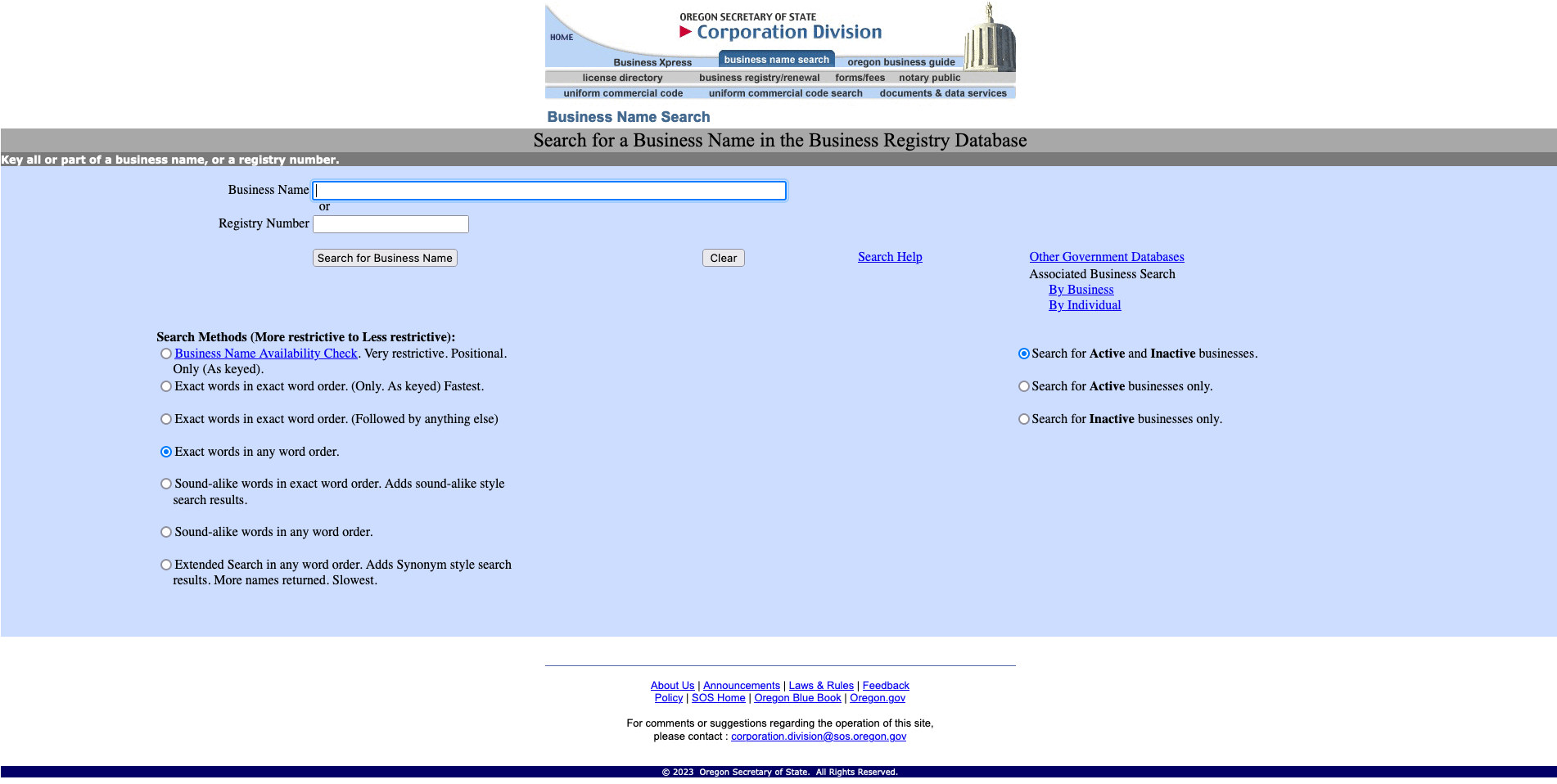

Once you have entered the new page https://egov.sos.state.or.us/br/pkg_web_name_srch_inq.login, enter your desired business name in the "Business Name" field and click on the 'Search for a Business Name' button.

Exploring Search Methods

Oregon's SOS business search also offers ways to filter your search. As you can see, the filters are very straightforward and do not require any explanation.

- Search for Active and Inactive Businesses.

- Search for Active Businesses Only.

- Search for Inactive Businesses Only.

- Exact Words in Exact Word Order.

- Exact Words in Any Word Order.

- Sound-Alike Words in Exact Word Order

- Sound-Alike Words in Any Word Order.

- Extended Search in Any Word Order.

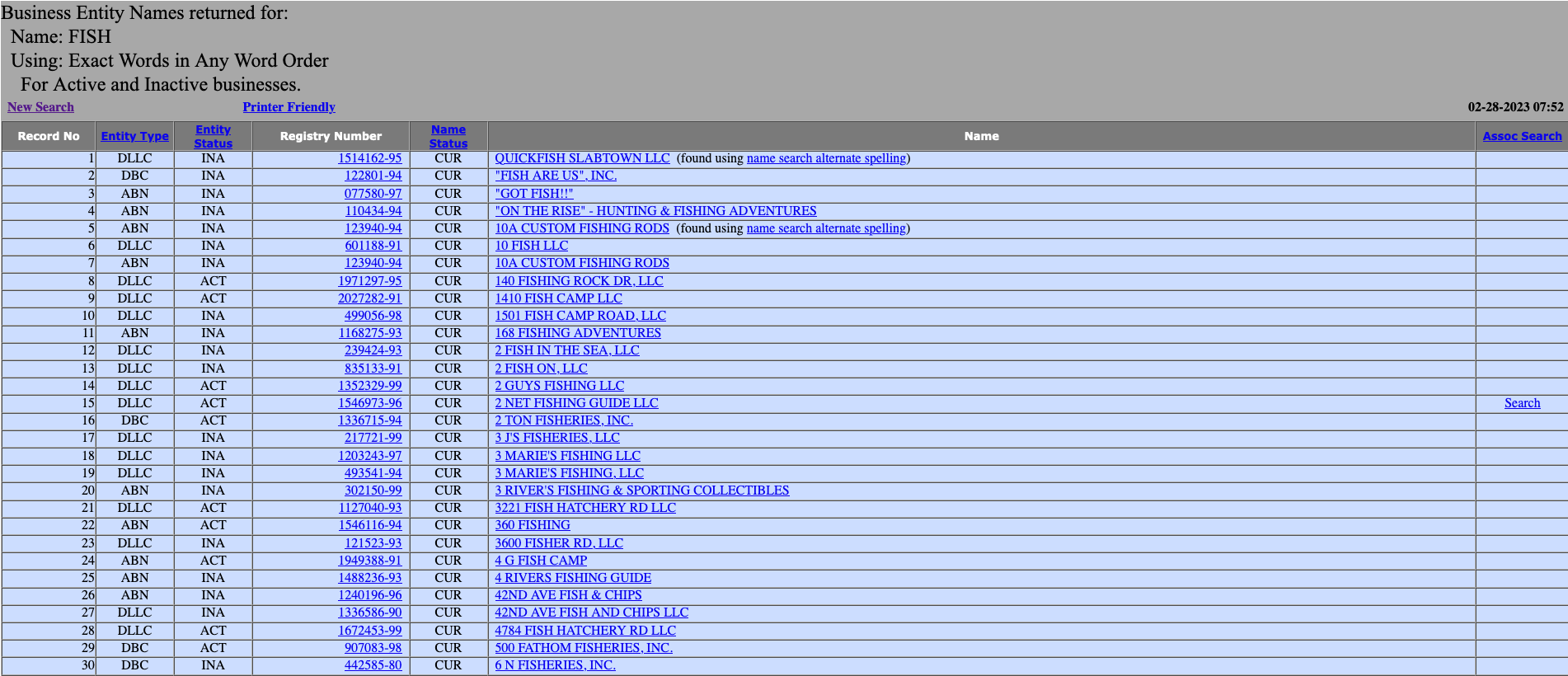

Review Your Results

The next page will present you with a list of business names currently registered with the state. In addition, the sheet provides you with several indicators, such as:

- Record No: A unique identifier for each business entity.

- Entity Type: The type of entity you are searching for.

- Entity Status: Active or expired.

- Name: Name of the Business

- Registry Number: A unique number for each entity.

- Name Status: Approved or disapproved.

- Name Assoc Search: This is the business name associated with another entity.

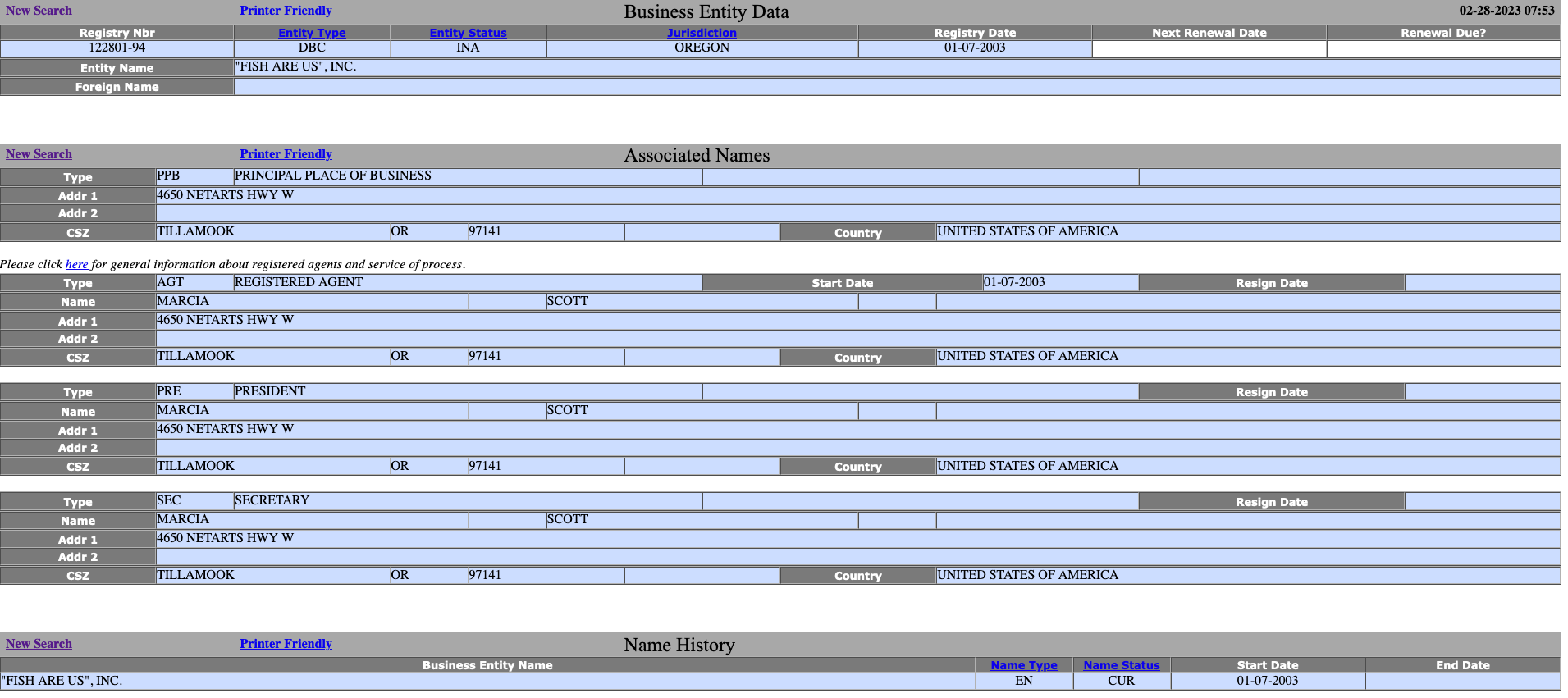

In-Depth Details

Finally, as you find a business name you're interested in, you may click the name of the business to view further details such as mailing address, name history, business type, and registration date.

Once you have conducted an Oregon business search and found a unique name not associated with another entity, you are ready to register your business in the state.

Oregon Business Search FAQs

What Does it Cost to Conduct an Orgeon SOS Business Search?

There is no cost to conduct a business search with the Oregon Secretary of State.

What Can Different Entity Types be Searched?

You can search for various entity types, including LLCs, corporations, limited partnerships, and sole proprietorships.

Is it Necessary to Register a Business in Oregon?

Yes, if you plan to do business in Oregon, you must register your business with the Oregon Secretary of State.

What are the Different Types of Business Entities in Oregon?

Oregon offers several different types of business entities for entrepreneurs to choose from. Oregon's most common types of businesses are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each entity has its advantages and disadvantages, so it's important to understand the differences before deciding which one is right for you.

- Sole Proprietorship: A sole proprietorship is a business owned by one person. It is the simplest business entity and does not require formal paperwork or registration with the state. However, the owner is personally liable for all debts and obligations of the business.

- Partnership: A partnership is a business owned by two or more people. Partnerships can be general or limited, depending on how much control each partner has over the business. All partners are jointly liable for all debts and obligations of the business.

- Limited Liability Company (LLC): An LLC is a hybrid between a corporation and a partnership that provides limited liability protection to its owners while allowing them to take advantage of pass-through taxation like a partnership. LLCs must register with the state and file annual reports to remain in good standing with the state.

- Corporation: A corporation is an independent legal entity owned by shareholders with limited personal liability for the company's debts and obligations. Corporations must register with the state, hold annual meetings, keep corporate records, issue stock certificates, and file annual reports to remain in good standing with the state.

No matter which type of entity you choose, it's important to consult an attorney or accountant when setting up your business in Oregon to ensure that you comply with all applicable laws and regulations.

What is the cost of registering a Business in Oregon?

The cost to register a business in Oregon depends on the type of business you are registering. For example, corporations must file Articles of Incorporation and pay a $100 fee for both filings. Additionally, registering your business entity name with the state costs $100.

If you are forming an LLC (limited liability company), the filing fee is $100 and must be paid to the Oregon Secretary of State when filing your Articles of Organization. You will also need to submit an annual report each year, which costs $100 to file.

It is important to note that all fees must be paid in advance and are non-refundable.

In conclusion, understanding the cost associated with registering a business in Oregon is essential before starting your venture. The cost varies depending on the type of business you are registering but typically ranges from $100-$200.

Do You Need to Trademark a Business Name in Oregon?

Doing business in Oregon requires that you protect your brand and reputation by registering a trademark for your business name. A trademark is a form of intellectual property that can identify goods or services from one business to another. In Oregon, trademarks are registered with the Secretary of State.

Registering a trademark in Oregon begins with searching the Oregon Business Registry database to ensure the name is available. If the name is available, you must apply with the Secretary of State and pay a non-refundable fee of $50. The application must include the name and business address of the person applying for registration and information about any goods or services associated with the trademark.

Once your application has been filed, it will be reviewed by an examiner who will determine whether it meets all registration requirements. If approved, your trademark will be registered, and you will receive a registration certificate from the Secretary of State. This certificate proves that you own the trademark and can use it to protect your brand from infringement or misuse by other businesses.

It's important to note that registering a trademark in Oregon does not protect outside-of-state lines. To ensure full protection, you may need to register your trademark at the state and federal levels. Additionally, if you plan on doing business in other states, checking their laws regarding trademarks before applying to Oregon is important.

How Much Does it Cost to Register an LLC in Oregon?

Establishing a limited liability company in Oregon requires an Articles of Organization filing with the state Secretary of State, which has a fee of $100. Annual reports must also be submitted annually; domestic LLCs must pay $100 for these filings, while foreign LLCs must submit payments worth $275.

Related Business Search Articles

- Wisconsin Corporation Search

- Louisiana Business Entity Search

- North Carolina (NC) Secretary of State Corporation Search

- Utah Business Entity Search

- How to Conduct an Illinois Business Search

- How to Conduct a Delaware Business Entity Search

- Nevada SOS Business Search

- Florida Business Entity Search: FL SOS & SunBiz Search Guide

- How to Conduct an Oregon Business Search

- How to Conduct a Maryland Business Search

- How to Conduct an Idaho Business Entity Search

- CT Business Lookup: Search for a Business in Connecticut

- Conduct a Minnesota SOS Business Search

- New Jersey Secretary of State Business Search

- Texas Secretary of State Business Search (SOS)

- Michigan Business Entity Search

- New York Secretary of State Business Search (NY SOS)

- Arkansas Secretary of State Business Search

- Colorado Business Entity Search