Texas Secretary of State Business Search (SOS)

Discover foolproof methods for conducting a Texas Secretary of State (SOS) Business Search effectively. Learn more and elevate your search skills now!

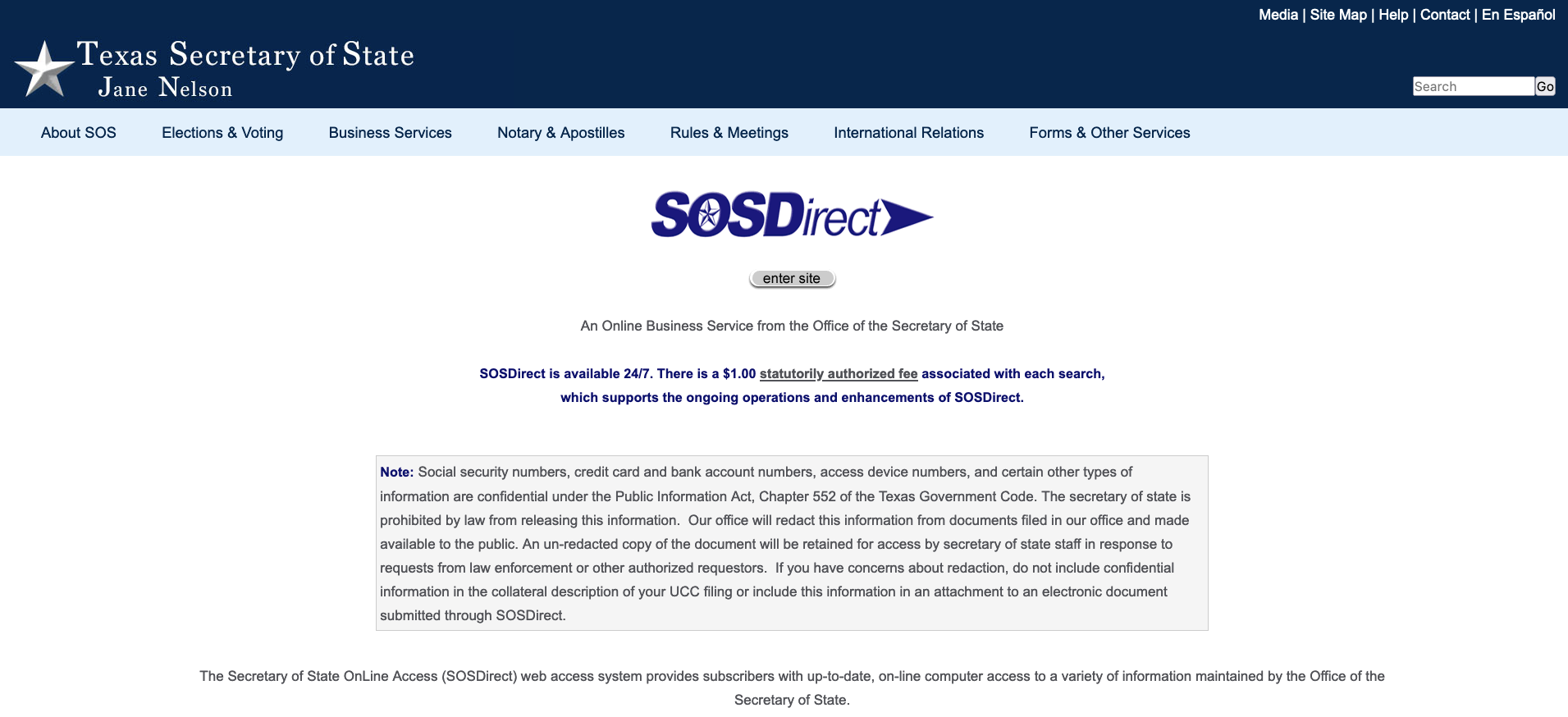

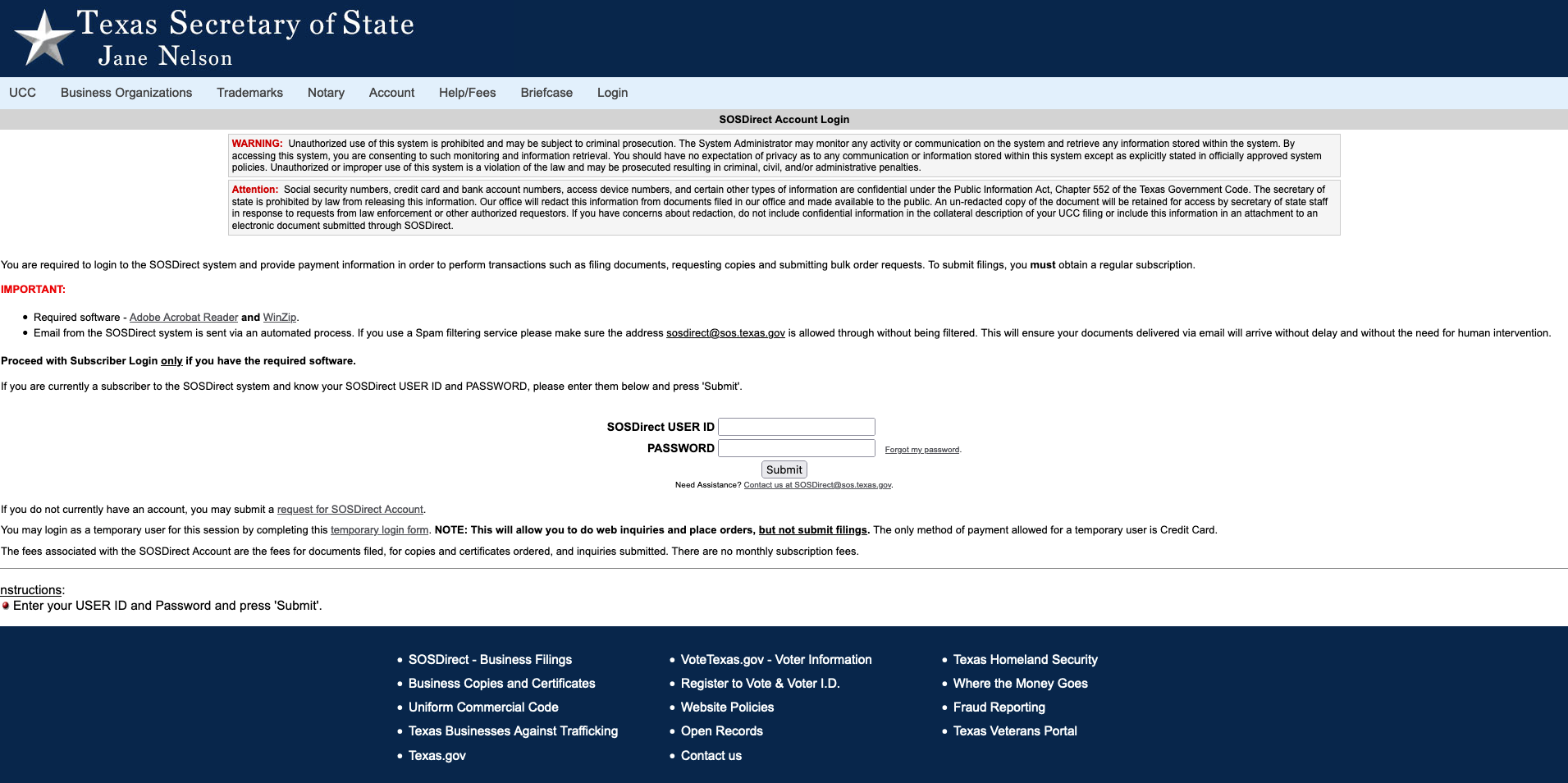

Understanding the Search Portal

You can initiate your search on the Taxable Entity Search page located on the Texas Comptroller of Public Accounts website. This search interface permits queries by Tax ID number, File Number, or by name. Each search attempt necessitates clicking on the "I'm Not a Robot" button, usually without any further verification. It is important to note that each search result costs $1 and requires an account.

Refining Your Search

Should your search yield an excess of records (more than 500), a further refinement of your search is essential. One downside of this page is the lack of an advanced search function, meaning you cannot filter by additional criteria and can only modify the search parameters. When you have sufficiently fine-tuned the parameters, your search results appear.

Interpreting the Results

An overview of the search results presents basic details about the business, such as the name, Tax ID number, and zip code. For a more comprehensive view, you need to click the details button on the left.

The details window reveals the company's mailing address, the state in which the business was established, the date of registration with the Secretary of State and the SoS file number, the name of the registered agent, and the address of the registered office. This address may not always correspond with the mailing address of the business itself.

Understanding the Company's Status

Additionally, this window displays the company's current status concerning its entitlement to transact business in Texas. There are six possible statuses. To elucidate any unfamiliar terms, you can click on the little question mark adjacent to each status.

Accessing the Public Information Report

Upon clicking the Public Information Report tab located at the top of the window, you gain access to more data. This includes contact information for individuals listed as directors and members of the company.

How to Start a Business in Texas

As an entrepreneur, starting a business in Texas is an exciting venture. The state of Texas is renowned for its remarkable business ecosystem, often ranked as the ideal destination for budding businesses. Its prime business climate, coupled with a favorable regulatory environment, lays a robust foundation for small businesses and entrepreneurs to thrive.

Let's walk you through the basic steps of initiating a business in Texas. However, it is recommended that you consult a professional tax consultant, accountant, or attorney to ensure all legal prerequisites are met before establishing your business.

Choosing a Business Entity

Before diving into the process of starting a business in Texas, it's crucial to understand the available options for business entities. The most common type of business entity for small businesses in Texas is the Limited Liability Company (LLC). Other types include the C-Corporation and S-Corporation. For entrepreneurs who prefer simpler structures, there are also options for a Sole Proprietorship, General Partnership, or Limited Partnership.

Each business entity has its unique benefits, tax implications, and legal protections. Therefore, it's necessary to research and consult with a business advisor or attorney to select the most suitable option for your business venture.

Naming Your Business

Once you've chosen a suitable business entity, the next step is choosing a name for your business. If the business name differs from your legal name or your LLC's or corporation's name, you'll need to file a Doing Business As (DBA) with the state of Texas.

Getting an Employer Identification Number

An essential step when starting a business in Texas is obtaining an Employer Identification Number (EIN) from the IRS. An EIN is required for hiring employees, filing taxes, and opening a business bank account. It's essentially your business's social security number.

Hiring a Registered Agent

Texas law mandates that businesses filing formation papers with the state must have a registered agent. A registered agent is a person or entity that can receive legal documents on behalf of your business. This requirement ensures that the state has a reliable way to communicate with your business.

Applying for Business Licenses

Before commencing operations, ensure you have all the necessary business licenses. Requirements can vary at the federal, state, and local levels. Consulting with a business advisor can assist in navigating these requirements and ensuring you're compliant.

Opening a Business Bank Account

Separating personal and business finances is vital for financial transparency and ease of bookkeeping. Opening a business bank account will help achieve this separation.

Insuring Your Business

Business insurance, although not always legally required, is a safety net every business should have. It offers financial protection in case of unforeseen circumstances like natural disasters or accidents. Various types of business insurance exist, so it's crucial to select the one most suitable for your specific business needs.

Utilizing Business Software Tools

Efficiency and streamlined operations are the backbones of a successful business. Various software tools, including accounting software, point-of-sale (POS) software, payroll software, and customer relationship management (CRM) software, can greatly simplify your business processes and improve productivity.

Financing Your Business

The cost of forming a business entity in Texas starts at $300 for LLCs and corporations. Additionally, there will be other startup costs associated with your specific business. You may need to consider various financing options to cover these costs. These options can include business loans, raising capital from investors, small business grants, and personal savings.

Launching Your Business

Once all these elements are in place, you're ready to commence operations. The exact steps will depend on the nature of your business. For instance, selling digital goods and dropshipping are relatively easy businesses to start, requiring low overhead costs.

Why Should You Start a Business in Texas?

With a reputation for doing everything bigger and better, Texas proudly boasts a thriving business environment. Notably, the Lone Star State is home to about 99% of small businesses across the nation, making it a hotbed for entrepreneurs. Entrepreneurs are drawn to Texas for a variety of reasons, ranging from the availability of top-tier talent to attractive financial incentives and tax breaks.

Unmatched Talent Pool in Texas

A successful startup requires a competent and efficient team to lead it to success. Each member, from HR to engineers, plays a crucial role in the venture's development. Rapid hiring, however, can lead to missteps in selecting the right fit for a position. The rush to fill a position often results in overlooking vital skills necessary for a role.

In contrast, Texas offers a robust solution to this challenge. Ranked second for the workforce by CNBC's 2022 America's Top States for Business report, Texas ensures a steady supply of qualified candidates. As a consistent top-five state for business, the state attracts a tremendous amount of interest from business owners considering where to establish their operations. Furthermore, having a financial buffer for initial expenses is crucial while awaiting profits.

Significant Tax Benefits for Businesses in Texas

Traditionally, Delaware and Nevada were primary choices for entrepreneurs, primarily due to their business-friendly corporate tax laws. However, more states are enacting tax laws to attract businesses, with Texas becoming a notable example. The Tax Foundation's 2023 State Business Tax Climate Index ranked Texas among the top 15 states due to its lack of individual income tax or corporate income tax. Combined with a booming economy, Texas remains an appealing choice for startups.

A State Receptive to Innovation

When considering locations synonymous with innovation, the East and West coasts, particularly Silicon Valley in California and Manhattan in New York, are typically top of mind. However, Texas is rapidly changing this perception.

Events such as South by Southwest (SXSW) held in Austin annually, showcase the state's thriving tech and media scene. Additionally, Texas has over 380 airports, constantly welcoming new individuals eager to explore the state's diverse culture and industry. From advanced tech and manufacturing to energy and petroleum refining, Texas is home to a plethora of growing industries.

The large population, coupled with efforts to support minority entrepreneurs, facilitates the state's diverse economy. According to the Texas Economic Development Corporation, this diversity enables Texas to lead the nation in job creation, a trend expected to continue into the future.

A Favorable Environment for Small Businesses

The United States Small Business Friendliness Survey evaluates how states across the U.S. receive small businesses. Texas received a B grade for overall state friendliness in 2021, although the state has previously consistently received A grades. Despite this, Texas received an A grade for the ease of starting a business, regulations, employment, labor and hiring, tax code, and licensing. Many of these factors have seen a grade increase since 2019.

It's essential to remember that starting a business, whether in Texas or elsewhere, does not guarantee success. Planning and preparation are the keys to overcoming potential challenges and laying a solid foundation for any business. Additionally, it's noteworthy to mention that about 43% of businesses in Texas are owned by women, per the U.S. Small Business Administration.

Conclusion

Carrying out a Texas Secretary of State business search may initially seem time-consuming and taxing. However, by understanding the search platform and knowing where to look, you can quickly and effectively find the business information you need. It's important to remember the importance of due diligence, especially when onboarding new clients. Knowledge is power, and with the information from the Texas Secretary of State at your fingertips, you can ensure you have all the knowledge necessary to make informed decisions.

Related Business Search Articles

- Wisconsin Corporation Search

- Louisiana Business Entity Search

- North Carolina (NC) Secretary of State Corporation Search

- Utah Business Entity Search

- How to Conduct an Illinois Business Search

- How to Conduct a Delaware Business Entity Search

- Nevada SOS Business Search

- Florida Business Entity Search: FL SOS & SunBiz Search Guide

- How to Conduct an Oregon Business Search

- How to Conduct a Maryland Business Search

- How to Conduct an Idaho Business Entity Search

- CT Business Lookup: Search for a Business in Connecticut

- Conduct a Minnesota SOS Business Search

- New Jersey Secretary of State Business Search

- Texas Secretary of State Business Search (SOS)

- Michigan Business Entity Search

- New York Secretary of State Business Search (NY SOS)

- Arkansas Secretary of State Business Search

- Colorado Business Entity Search