Utah Business Entity Search

Do you want to set up your business in Utah? Here's just the guide for you! Learn how to conduct a Utah Business Entity Search in our easy-to-follow guide.

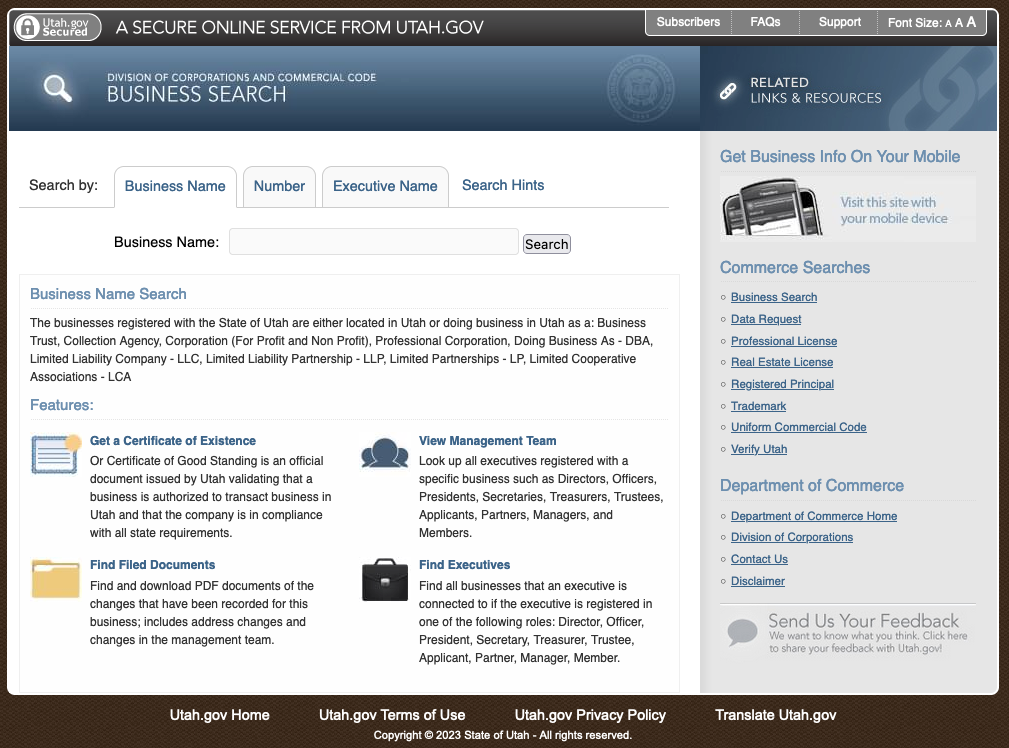

Understanding the Utah Division of Corporation and Commercial Code

The Utah Division of Corporation and Commercial Code is your central hub for information related to Utah business entities. The division dutifully maintains records and databases, enabling you to search and access vital information with ease.

Business Search Options

When it comes to conducting a search, the Utah Division provides flexibility with several search parameters. You can look up businesses by their name, ID number, or even the name of an executive. The most popular choice among these options is the "Name" search, which generates a list of names linked to the inputted business name.

Utilizing Filing Numbers for Search

Each registered corporation in Utah is assigned a unique filing number. This number becomes an incredibly useful tool when conducting a more specific search. It's a clear, succinct way to access the precise entity you're seeking, bypassing potentially confusing namesakes and homonyms.

Generating Business Name Ideas

The Utah business entity search isn't just a tool for finding existing businesses. It can also act as a brainstorming device. A cursory glance through the search results list can reveal dissolved names, providing a fertile ground for potential business name ideas. However, before you decide on a name, it's advisable to confirm its availability by reaching out to the Utah Secretary of State's office.

The Necessity of a Trademark Search

Trademark issues can create unwanted roadblocks on your journey to business success. To sidestep such issues, perform a comprehensive trademark search before settling on a business name. This proactive step ensures that your chosen name isn't infringing on any existing trademarks and helps to safeguard your brand's identity.

Checking Domain Name and Social Media Availability

In today's digital age, your business's online presence is paramount. Therefore, ensure that your chosen name's domain and social media handles are available. This step will help you build a consistent, recognizable brand across all platforms.

Registering Your Business Entity with the Utah Corporation Commission

Once you've navigated the search and selection process, the next step is to officially register your business entity with the Utah Corporation Commission. This commission acts as the gatekeeper, granting your business the official status it requires to operate within the state's boundaries.

Assistance with the Filing Process

The filing process might seem overwhelming, but you don't have to tackle it alone. Several companies specialize in assisting with this procedure, easing your burden and ensuring accuracy in the process.

Securing a Tax ID/EIN from the IRS

For tax purposes, it's vital to obtain a Tax ID/EIN from the IRS. This number is a requirement for your business, making it a necessary step in your business formation journey.

The Importance of a Logo

A logo can act as the face of your business, differentiating your brand and leaving a lasting, positive impression. Consider creating a unique and memorable logo to add visual flair to your brand identity.

Writing a Business Plan

A well-structured business plan is more than just a document—it's a roadmap to your success. This plan helps organize your thoughts, strategies, and goals, all while serving as a powerful tool to impress potential investors.

Opening a Business Bank Account

Keeping personal and business finances separate is crucial for maintaining clear records and staying organized. To achieve this, opening a business bank account is a must. This account serves as the financial hub of your business operations, giving you a clear overview of your income and expenses.

Establishing a Business Mailing Address

A business mailing address is more than a location for correspondence—it's a representation of your business's physical presence. It's important to note that PO boxes are not accepted when opening a business bank account. So, ensuring you have an established business mailing address is a crucial part of the process.

The Advantages of Starting a Business in Utah

A Land of Opportunity: Utah's Entrepreneurial Landscape

Tired of the familiar grind? Seeking a place where your entrepreneurial seeds can take root and flourish? Look no further than Utah. With its welcoming atmosphere for business owners and innovative minds, this state offers an intriguing blend of entrepreneurial spirit, breathtaking landscapes, and a friendly community eager to support your endeavors.

The Power of Small Business in Utah's Economy

Utah's economy is a dynamic force, with a gross state product of $182.88 billion. At the heart of this economic powerhouse lie small businesses, representing an impressive 99.3% of all private enterprises in the state. These enterprises not only contribute significantly to the economic health of the state but also play a crucial role in employment, with 45.4% of all Utah employees finding their livelihoods in small businesses.

This potent impact is not limited to the domestic front. Utah's small businesses also make their mark on the global scene, exporting goods worth a whopping $11.1 billion in 2019. From veterans to women to racial minorities, small businesses in Utah are as diverse as the landscape itself, providing opportunities for all.

The People Behind Utah's Small Businesses

Utah's small businesses are powered by a diverse workforce. With approximately 606,609 Utahns employed by small businesses, these enterprises form a significant part of the state's employment landscape. The state's labor laws ensure that all employees receive fair wages, with provisions for tip credits, training minimum wages, and overtime pay.

A Closer Look at Utah's Small Business Industries

Utah's small business scene is as diverse as its landscapes. The professional, scientific, and technical services industry leads the way, with 51,628 small businesses currently operating in this sector. From nonemployer businesses to those employing hundreds, Utah's small business industries offer a rich tapestry of entrepreneurial activity.

Small Business Ownership: A Reflection of Utah's Diversity

Utah's population, which stands at 3,337,975 and growing, is a mosaic of ethnicities. Small business ownership is no different, reflecting the state's diverse demographic composition. From White/Caucasian to Hispanic/Latino, Asian, Black or African American, Native Hawaiian, and American Indian and Alaska Native, all ethnic groups contribute significantly to Utah's vibrant small business landscape.

The Role of Gender in Utah's Small Business Ownership

In Utah's small business scene, women are making their mark, owning 101,750 enterprises. Men, too, own a significant number of small businesses, with 165,255 to their name. Jointly owned businesses also form a part of this diverse landscape, creating a well-rounded entrepreneurial ecosystem.

The Impact of COVID-19 on Utah's Businesses

The global pandemic has left no corner of the world untouched, and Utah's businesses have had their share of impact. The state ranks 45th in terms of economic exposure to COVID-19. However, Utah's resilience shines through, with businesses continuing to operate and adapt in these challenging times.

Financing Opportunities for Small Businesses in Utah

Financing is a crucial aspect of any business, and in Utah, small businesses have access to numerous financing opportunities. In 2019, banks contributed $691.9 million in loans to Utah businesses with revenues under $1 million. This substantial financial backing illustrates the commitment of the banking sector to supporting the growth and success of small businesses in Utah.

Navigating Business Taxes in Utah

Understanding and managing taxes is an essential part of running a successful business. In Utah, LLCs, as pass-through tax entities, are not required to pay income tax to the federal or state government. Instead, the income is passed on to the individual LLC members who then pay federal and state taxes on their earnings.

However, LLCs can choose to be classified as corporations, in which case they would be liable to pay Utah's corporate tax. With a top corporate income tax rate of 4.95%, Utah offers a favorable tax environment for businesses. By hiring a reliable registered agent firm, entrepreneurs in Utah can effortlessly manage their tax responsibilities and stay ahead of their filing deadlines.

The Role of Small Businesses in Utah's Export Landscape

Utah's small businesses make a significant contribution to the state's exports. In 2019, small businesses accounted for 84.5% of exporters, shipping goods worth $11.1 billion. This accounts for 67.3% of total exports by identified businesses, underscoring the crucial role of small businesses in Utah's international trade.

Utah Business Entity Search FAQs

What is the Utah Division of Corporation and Commercial Code?

The Utah Division of Corporation and Commercial Code is an online platform that maintains records of all Utah business entities. It enables users to conduct business entity searches by various parameters.

How Can I Search for a Business Entity in Utah?

You can search for a business entity by business name, ID number, or executive name on the Utah Division of Corporation and Commercial Code's website.

What is a Filing Number?

A filing number is a unique identifier assigned to each corporation in Utah. It can be used to conduct a specific search.

Can I Use the Search Tool to Generate Business Name Ideas?

Yes, you can look through the search results list for dissolved names, which can provide potential business name ideas. However, you should confirm the availability of the name before using it.

Why is a Trademark Search Important?

A trademark search ensures that your chosen business name isn't infringing on any existing trademarks, thereby protecting your brand's identity.

How Do I Register My Business Entity in Utah?

You can register your business entity with the Utah Corporation Commission. Companies like Northwest Registered Agent, or ZenBusiness can assist with the process.

What is a Tax ID/EIN?

A Tax ID/EIN is a number obtained from the IRS, required for tax purposes when setting up a business.

Why Do I Need a Business Bank Account?

A business bank account helps keep personal and business finances separate. It's a necessity for maintaining clear financial records.

Why Do I Need a Business Mailing Address?

A business mailing address is required for official correspondence and is necessary for opening a business bank account.

What is the Importance of a Business Plan?

A business plan organizes your ideas, strategies, and goals. It is a valuable tool for impressing potential investors and mapping out your business's future.

What Is the Definition of a Small Business in Utah?

In Utah, a small business can be a partnership, sole proprietorship, or privately owned corporation, employing fewer than 500 people.

What Is the Employment Rate in Small Businesses in Utah?

Small businesses employ 45.4% of all employees in Utah, which is approximately 606,609 individuals.

Which Industry Has the Highest Number of Small Businesses in Utah?

The professional, scientific, and technical services industry leads in terms of small business investment in Utah.

What Is the Ethnic Breakdown of Small Business Ownership in Utah?

Small business ownership in Utah is diverse, with White/Caucasian owning the majority, followed by Hispanic/Latino, Asian, Black or African American, Native Hawaiian and Other Pacific Islander, and American Indian and Alaska Native.

How Many Small Businesses in Utah Are Owned by Women?

Women own 101,750 small businesses in Utah.

How Has COVID-19 Affected Businesses in Utah?

Utah ranks 45th in terms of economic exposure to COVID-19. Despite the pandemic, businesses continue to operate and adapt.

How Much Financing Was Made Available to Small Businesses in Utah in 2019?

In 2019, banks in Utah provided $691.9 million in loans to businesses with revenues under $1 million.

What Is the Corporate Tax Rate in Utah?

Utah's top corporate income tax rate is 4.95%.

What Role Do Small Businesses Play in Utah's Exports?

In 2019, small businesses accounted for 84.5% of exporters in Utah, shipping goods worth $11.1 billion.

Why Should I Start a Business in Utah?

Utah offers a supportive environment for entrepreneurs with low taxes, excellent infrastructure, and a business-friendly administration. Moreover, the state's stunning landscapes and vibrant cultural life make it an attractive place to live and work.

What is an LLC?

An LLC, or Limited Liability Company, is a type of business structure that combines the flexibility and tax benefits of a partnership with the liability protection of a corporation.

Why Should I Start an LLC in Utah?

Starting an LLC in Utah allows you to benefit from personal liability protection, pass-through taxation, and operational flexibility. It's also a simple and affordable process.

What is a Registered Agent and Why Do I Need One for My Utah LLC?

A registered agent is a person or entity that agrees to accept legal papers on behalf of your LLC if it's sued. They serve as a reliable point of contact between your business and the state.

How Much Does It Cost to Start an LLC in Utah?

The primary cost to start an LLC in Utah is the $70 filing fee for the Certificate of Organization. However, other costs may include obtaining an EIN, hiring a registered agent, and drafting an operating agreement.

What is the Purpose of an Operating Agreement?

An operating agreement lays out the ownership and operational procedures of your LLC. It provides a clear framework for how your business will be run and serves as a crucial reference point in the face of disputes or misunderstandings.

What is an EIN?

An EIN, or Employer Identification Number, is a federal tax ID number used by the IRS to identify businesses for tax purposes. If your LLC has more than one member, it's necessary to obtain an EIN.

What is an Annual Renewal?

An annual renewal is a report that must be filed by all Utah LLCs each year, along with a $20 fee. This helps to keep your LLC in good standing with the state.

Can I Form an LLC in Utah to Provide Professional Services?

Yes, you can form an LLC in Utah to provide professional services, such as law or medicine. However, only members who are licensed or registered for that profession can perform the specific services for which the LLC was formed.

How Do I Choose a Name for My LLC?

Your LLC's name should be unique, memorable, and compliant with Utah's naming regulations. It must contain "Limited Liability Company," "Limited Company," or their abbreviations.

What Happens After I File My Certificate of Organization?

Once your Certificate of Organization is filed and approved, your LLC is legally created. You can then proceed with other steps, such as drafting an operating agreement, obtaining an EIN, and starting your business operations.

Conclusion

Starting a business in Utah might seem complex, but with the right guide, it becomes manageable. From picking a business name, to securing a Tax ID, to creating a standout logo, you're preparing to join Utah's dynamic business scene. Small businesses like yours are the backbone of the state's economy, contributing significantly and reflecting its diverse spirit. You're not just launching a business, you're joining a resilient community of innovators.

Related Business Search Articles

- Wisconsin Corporation Search

- Louisiana Business Entity Search

- North Carolina (NC) Secretary of State Corporation Search

- Utah Business Entity Search

- How to Conduct an Illinois Business Search

- How to Conduct a Delaware Business Entity Search

- Nevada SOS Business Search

- Florida Business Entity Search: FL SOS & SunBiz Search Guide

- How to Conduct an Oregon Business Search

- How to Conduct a Maryland Business Search

- How to Conduct an Idaho Business Entity Search

- CT Business Lookup: Search for a Business in Connecticut

- Conduct a Minnesota SOS Business Search

- New Jersey Secretary of State Business Search

- Texas Secretary of State Business Search (SOS)

- Michigan Business Entity Search

- New York Secretary of State Business Search (NY SOS)

- Arkansas Secretary of State Business Search

- Colorado Business Entity Search