New Hampshire (NH) Business Entity Search & Lookup

Conducting a New Hampshire Business Entity Search & Lookup is the first step to starting a business in the state. So, come on into BrandSnag and learn more!

Why Is a Business Entity Search Necessary in New Hampshire?

Knowing how to execute a business entity search is essential for various reasons. If you're planning to start a new business, you can ensure that your chosen name isn't already in use. Additionally, this search can assist current business owners in finding essential details about competitors or potential partners. In essence, the search function serves as a valuable resource for various stakeholders in the business community.

Platforms for Business Entity Search in NH

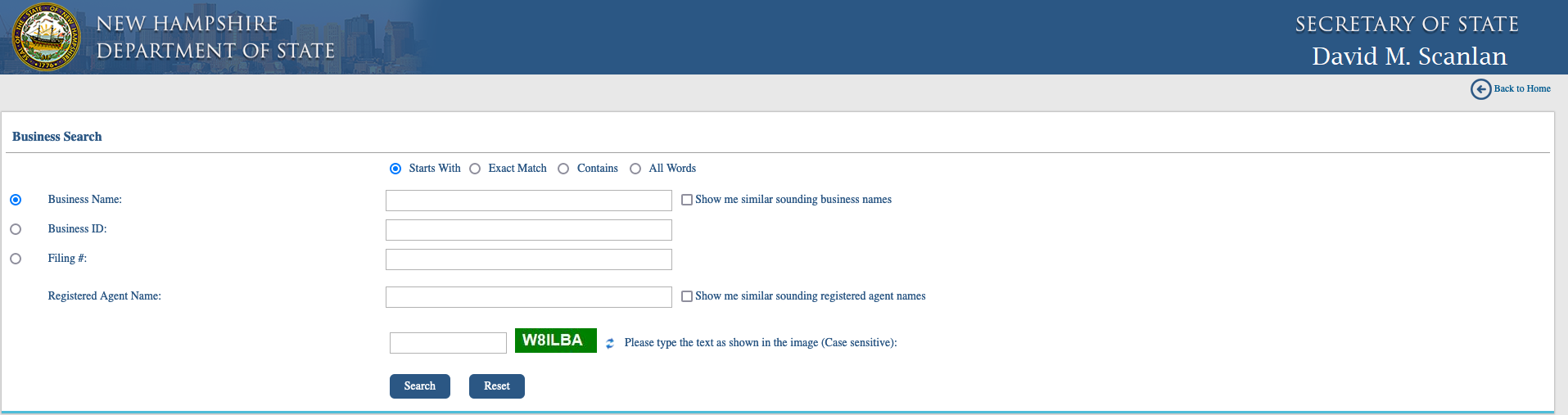

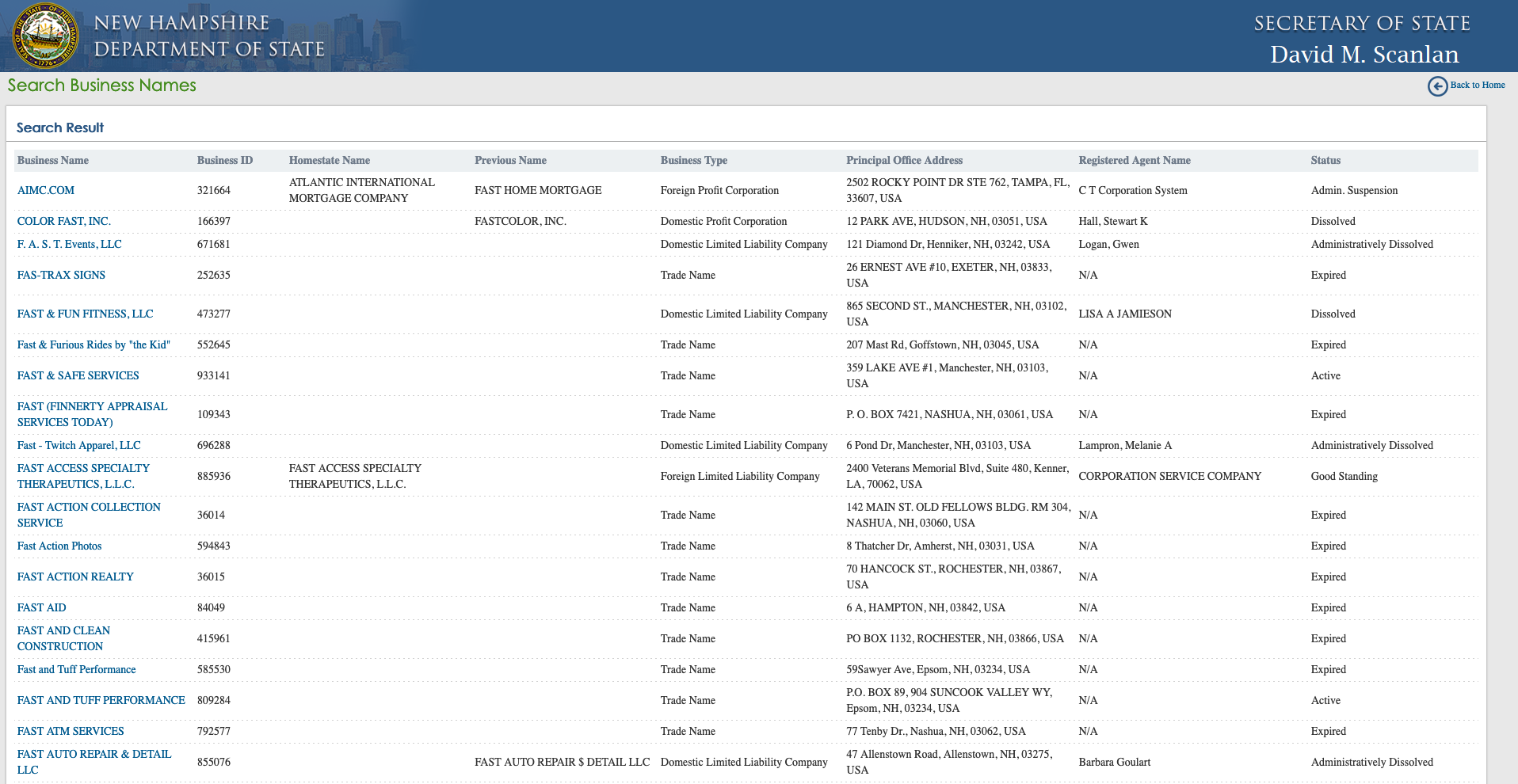

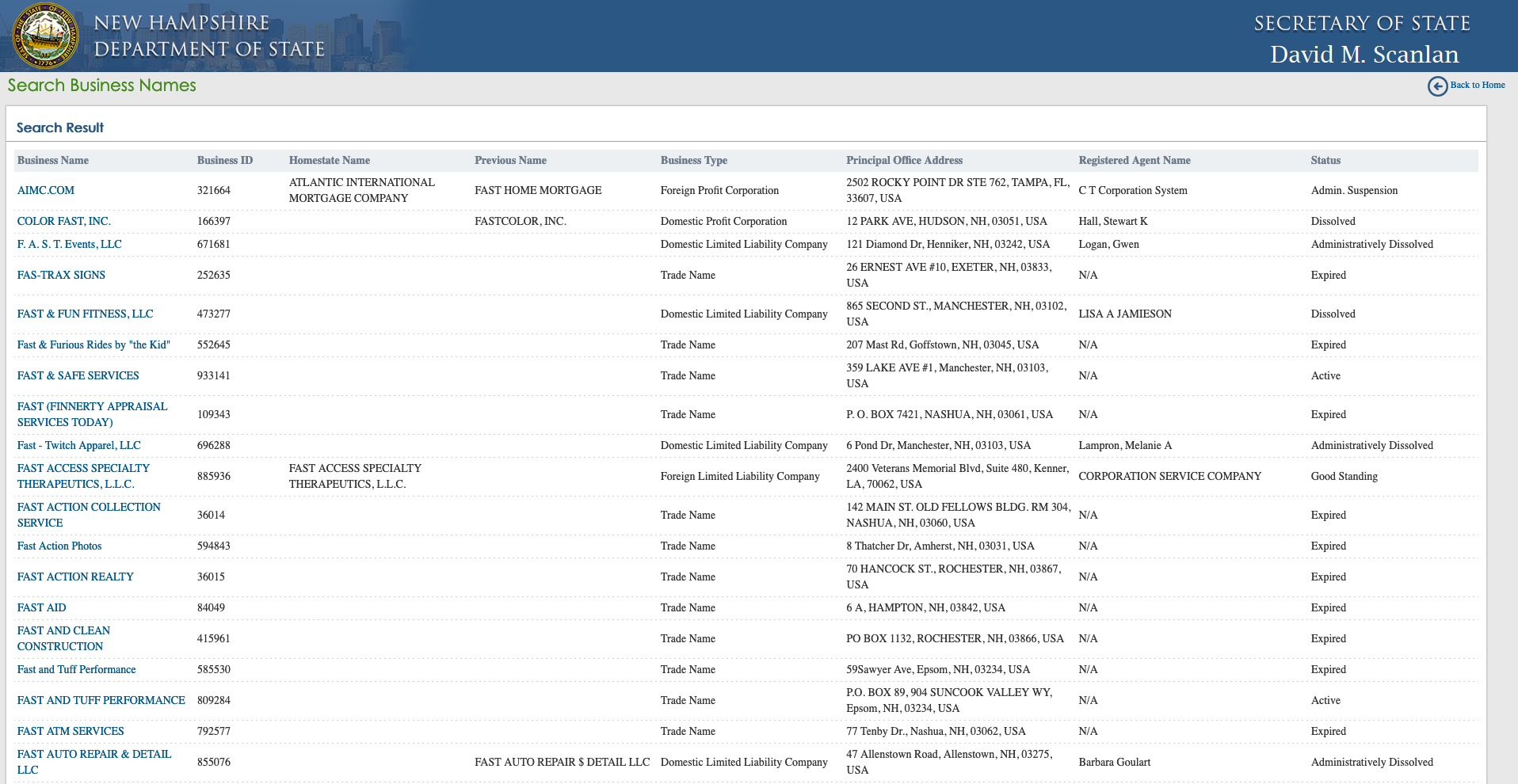

You can execute a New Hampshire business entity search via the New Hampshire Secretary of State website. The site allows for a wide range of search parameters, from business name to business ID, filing number, and registered agent name. The search engine on the website then provides a list of matching entries, revealing various details about each business.

New Hampshire Business Lookup Search Parameters and What They Mean

By Business Name

Searching by business name is the most straightforward approach. The search results will list all entities with a name closely resembling your query.

By Business ID or Filing Number

If you have a specific business ID or filing number, you can use it to locate exact records for the entity in question.

By Registered Agent Name

Registered agents are individuals or entities legally allowed to accept service of process on behalf of a business. Using this parameter narrows down the search to businesses associated with a particular registered agent.

Steps to Perform a Business Entity Search in New Hampshire

The process for conducting a business entity search in New Hampshire is relatively straightforward. Below are the steps to guide you through this process:

Access the Website

First, navigate to the New Hampshire Secretary of State's Business Entity Search page. This is the starting point for your search activity.

Enter Search Parameters

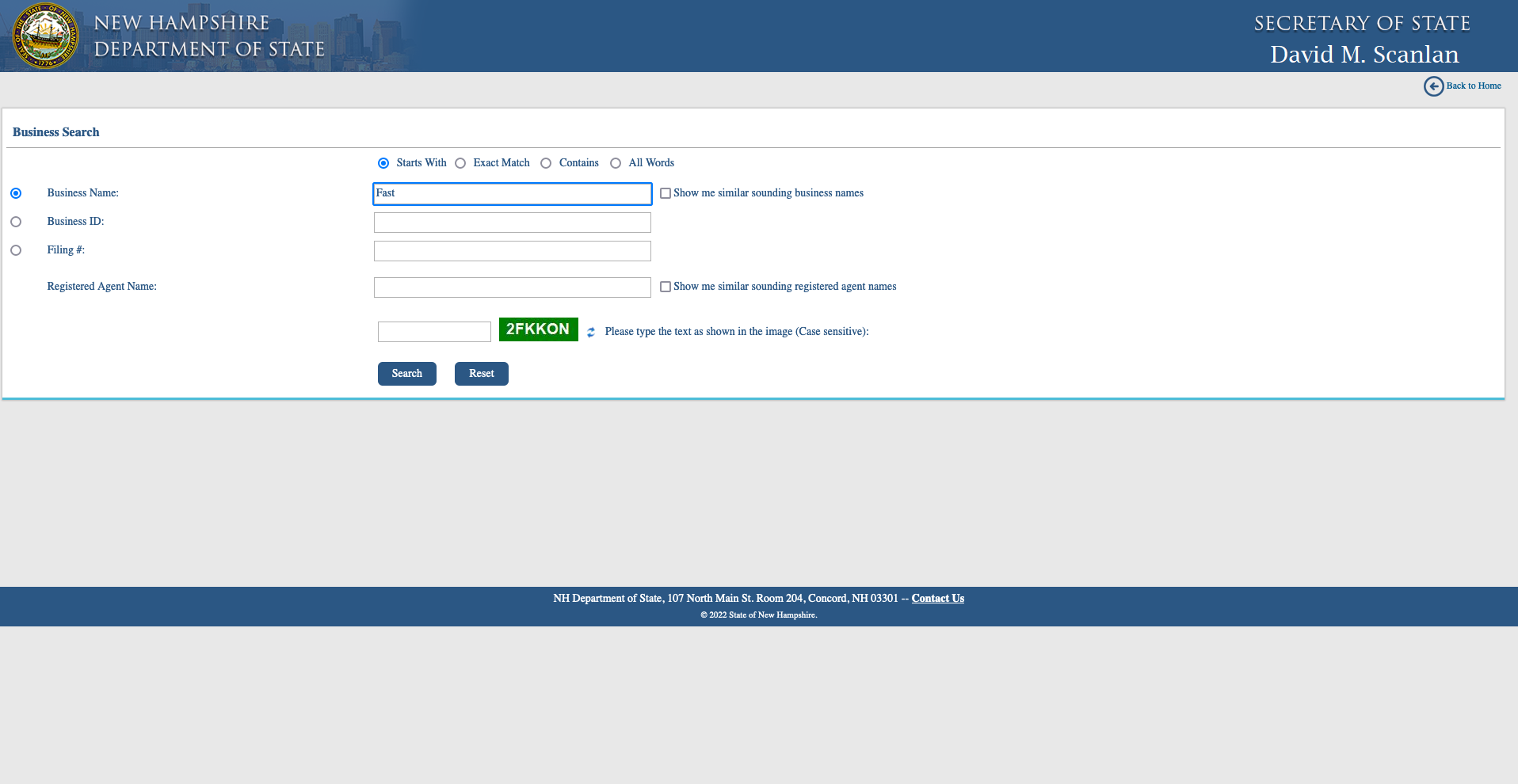

Input the details you have into the appropriate search fields. You can use the business name, business ID, filing number, or registered agent name as your search parameters.

View the Results

Once you have entered the necessary details, the website will produce a list of matching entries. Browse through this list to find the business entity you are looking for.

Examine the Business Information

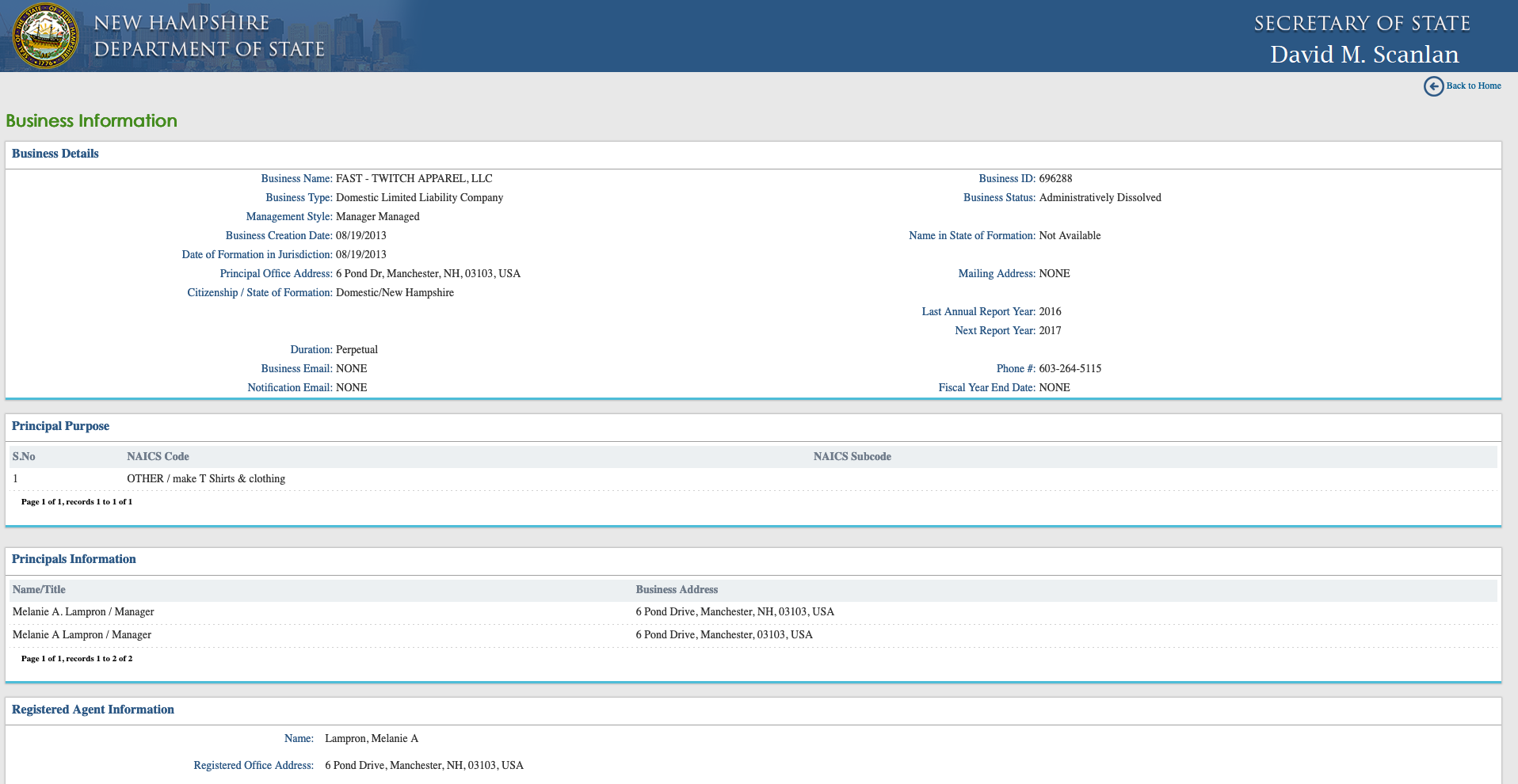

Click on the business name to view comprehensive details. This includes the business type, status, principal office address, and registered agent name. Additional information on the business entity's previous name, if it exists, can also be found here.

Confirm the Entity's Identity

The top section of the "Business Information" page contains the business name and ID. This will help you ascertain that you are reviewing the information of the correct entity.

Review Additional Information

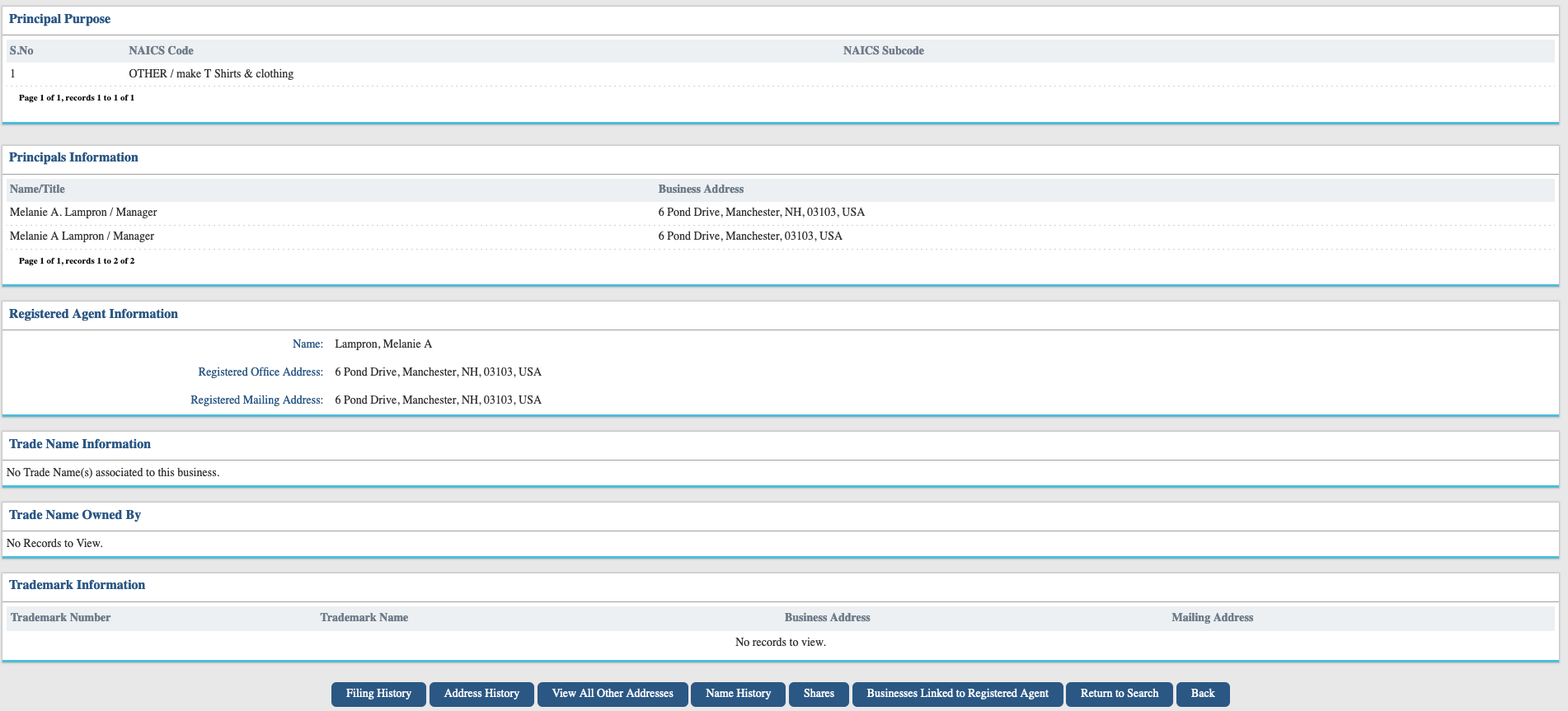

You will also find additional details about the company, such as board of director information and annual reports. Go through these to get a complete picture of the business entity in question.

How to Interpret NH Business Lookup Search Results

Interpreting the results of your search involves a detailed examination of the information provided. Here's how to go about it:

- Access Information: Start by accessing the New Hampshire Secretary of State's Business Entity Search website.

- Provide Search Information: Enter your desired search parameters like business name or registered agent name.

- Review Records: Upon executing the search, a list of matching entries will appear. Click on any entry to get more details.

- Analyze Business Information: Examine various aspects of the business, such as its name, ID, type, and status. Additionally, you can check the principal office address and the registered agent's name.

- Identity Verification: It's advisable to scrutinize the top part of the "Business Information" page to confirm the entity's identity.

- Additional Information: This could include looking at the principal or board of director information and any available annual reports.

Types of Business Entities You Can Search For in NH

The New Hampshire Secretary of State's database includes a variety of business entity types:

• Professional Corporations

• Business Corporations

• Limited Liability Companies (LLCs)

• Limited Partnerships

• Non-Profit Corporations (Inc.)

• Public Benefit Corporations (PBC)

• Sole Proprietorships

• General Partnerships

Steps to Register a Business Entity in New Hampshire

Once you've verified that your chosen business name is unique, you'll need to go through a registration process. Here are the general steps for registering a business entity in New Hampshire:

- Name Selection: Verify the uniqueness of your chosen business name by conducting a business entity search.

- Choose a Business Structure: Decide which structure best suits your business. Options include sole proprietorships, partnerships, LLCs, and corporations.

- Secretary of State Registration: Submit the necessary documents to the New Hampshire Secretary of State. This can be done online or by mail.

- Licenses and Permits: Secure any required licenses and permits from state or local government.

- Tax Registration: Register for state taxes with the New Hampshire Department of Revenue Administration.

- EIN Acquisition: Obtain an Employer Identification Number if you intend to hire employees or operate as a partnership or corporation.

New Hampshire (NH) Business Entity FAQs

How Long Does It Take to Start a Business in New Hampshire?

Starting a business in New Hampshire involves a timeline that's variable. The duration hinges on factors such as the kind of business entity you plan to establish and the mode of filing you opt for. You might find that the registration procedures could be completed in a short span of days or could extend to a few weeks.

What Resources Are Available for Small Business Owners in New Hampshire?

Small business owners in New Hampshire have access to multiple supportive resources. These include organizations like the New Hampshire Small Business Development Center, which offers consulting services and educational programs. Additional support comes from the New Hampshire Business Finance Authority that provides financial assistance. Also, the New Hampshire Division of Economic Development offers a range of programs and information to help businesses grow.

What Permits or Certifications Do I Need for My Specific Industry in New Hampshire?

Determining the permits and certifications your business may need in New Hampshire is dependent on the industry you're involved in. To ascertain what you may need, consult with entities such as the New Hampshire Department of Revenue Administration or the New Hampshire Business One Stop.

How Do I Obtain an EIN for My New Hampshire Business?

Securing an Employer Identification Number (EIN) for a business in New Hampshire can be done through various channels. The IRS website allows for online applications, but you can also apply by mailing a completed form or sending it via fax.

What Taxes Do I Need to Pay as a New Hampshire Business Owner?

While New Hampshire doesn't impose a state income tax or sales tax on businesses, it levies specific business taxes. Among them are the Business Enterprise Tax and the Business Profits Tax. The state also collects an Interest and Dividends Tax.

How Do I Choose a Business Name in New Hampshire?

Choosing a name for your business in New Hampshire involves ensuring that the name you prefer is not already registered by another entity. This can be verified by conducting a search on the New Hampshire Secretary of State website to ascertain the name's availability.

Do I Need a Business License to Operate in New Hampshire?

Operating a business in New Hampshire may or may not require a license, depending on your business type and location. To determine if you need one, consult with the New Hampshire Business One Stop.

What Are the Different Types of Business Entities in New Hampshire?

In New Hampshire, a variety of business entity options exist. These range from sole proprietorships and partnerships to more complex structures like limited liability companies (LLCs), corporations, limited partnerships, non-profit corporations, and public benefit corporations.

What Is the Cost of Registering a Business in New Hampshire?

Registering a business in New Hampshire incurs variable costs. The exact fee depends on the kind of business structure you opt for and the method of filing. Generally, you can expect to pay an amount between $50 and $100.

How Do I Register a Business in New Hampshire?

For business registration in New Hampshire, multiple steps are involved. These steps generally include deciding on a business name, identifying a suitable business structure, completing the necessary paperwork with the Secretary of State, securing any required licenses and permits, and applying for tax registration and an EIN. For the most up-to-date information, consult the New Hampshire Secretary of State's Office website or consult a legal expert.

Conclusion

Conducting a New Hampshire business entity search is a straightforward yet vital process for business owners and aspiring entrepreneurs. Not only does it help you comply with state regulations, but it also provides valuable insights into other registered businesses. Therefore, familiarize yourself with this process and make it a standard practice for your business activities.

Related Business Search Articles

- Wisconsin Corporation Search

- Louisiana Business Entity Search

- North Carolina (NC) Secretary of State Corporation Search

- Utah Business Entity Search

- How to Conduct an Illinois Business Search

- How to Conduct a Delaware Business Entity Search

- Nevada SOS Business Search

- Florida Business Entity Search: FL SOS & SunBiz Search Guide

- How to Conduct an Oregon Business Search

- How to Conduct a Maryland Business Search

- How to Conduct an Idaho Business Entity Search

- CT Business Lookup: Search for a Business in Connecticut

- Conduct a Minnesota SOS Business Search

- New Jersey Secretary of State Business Search

- Texas Secretary of State Business Search (SOS)

- Michigan Business Entity Search

- New York Secretary of State Business Search (NY SOS)

- Arkansas Secretary of State Business Search

- Colorado Business Entity Search

- Massachusetts Business Entity Search

- Oklahoma Secretary of State Business Search

- New Hampshire (NH) Business Entity Search & Lookup