Maine Secretary of State Business Search

If you're looking for a business in Maine, consider conducting a Maine Secretary of State Business Search. Learn more about the steps at BrandSnag.

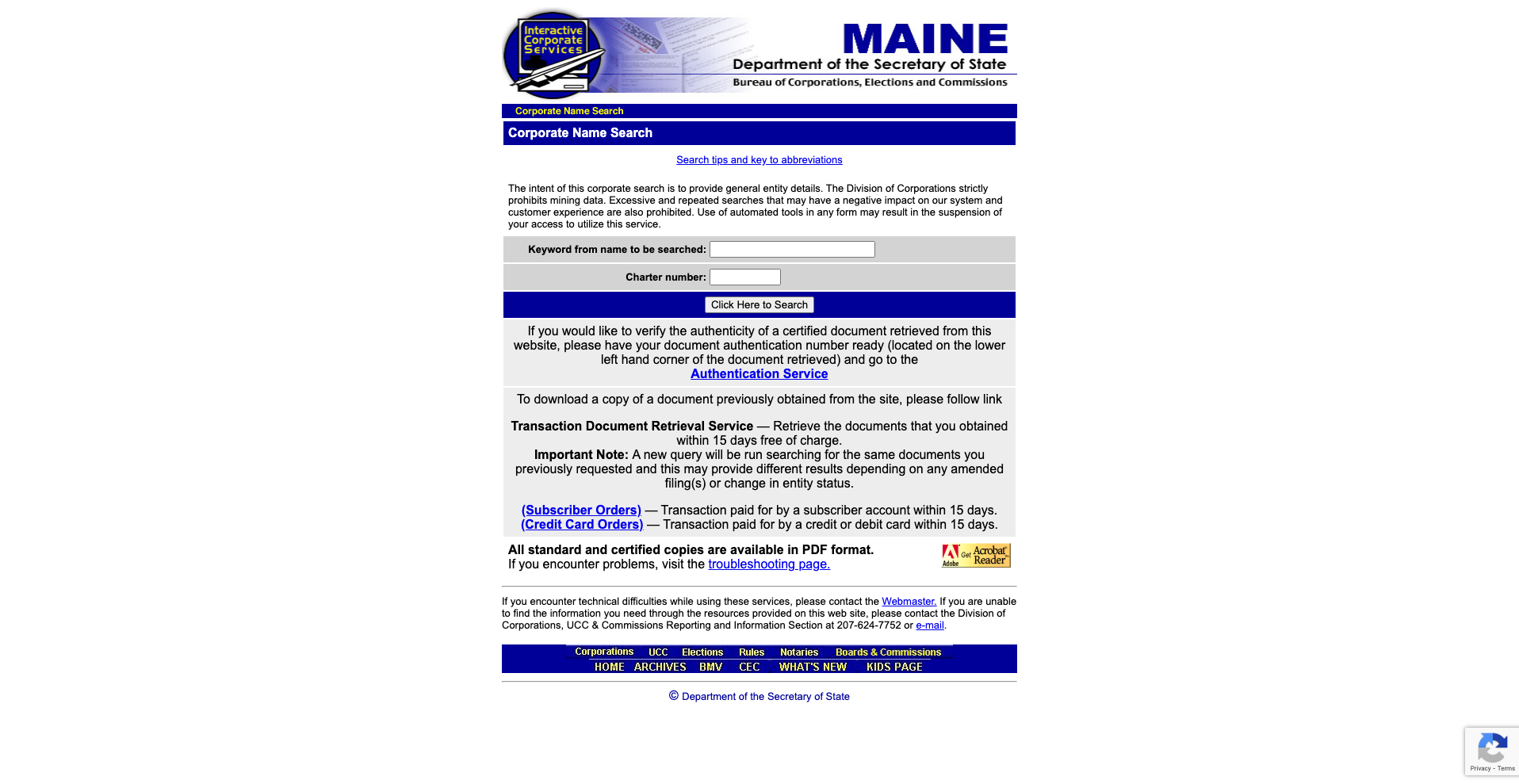

The Maine Secretary of State offers a Corporate Name Search tool through its Bureau of Corporations, Elections & Commissions. This feature is essential for anyone looking to access details about business entities registered in the state. Users can search for various types of businesses, such as corporations, limited liability companies, and limited partnerships. This tool provides a user-friendly interface where the primary method for searching is by entering the business name. There is no need to include formal business designations like "LLC" or "Corp" in your search query; the system automatically includes all entity types in the results.

Utilizing the Charter Number Search

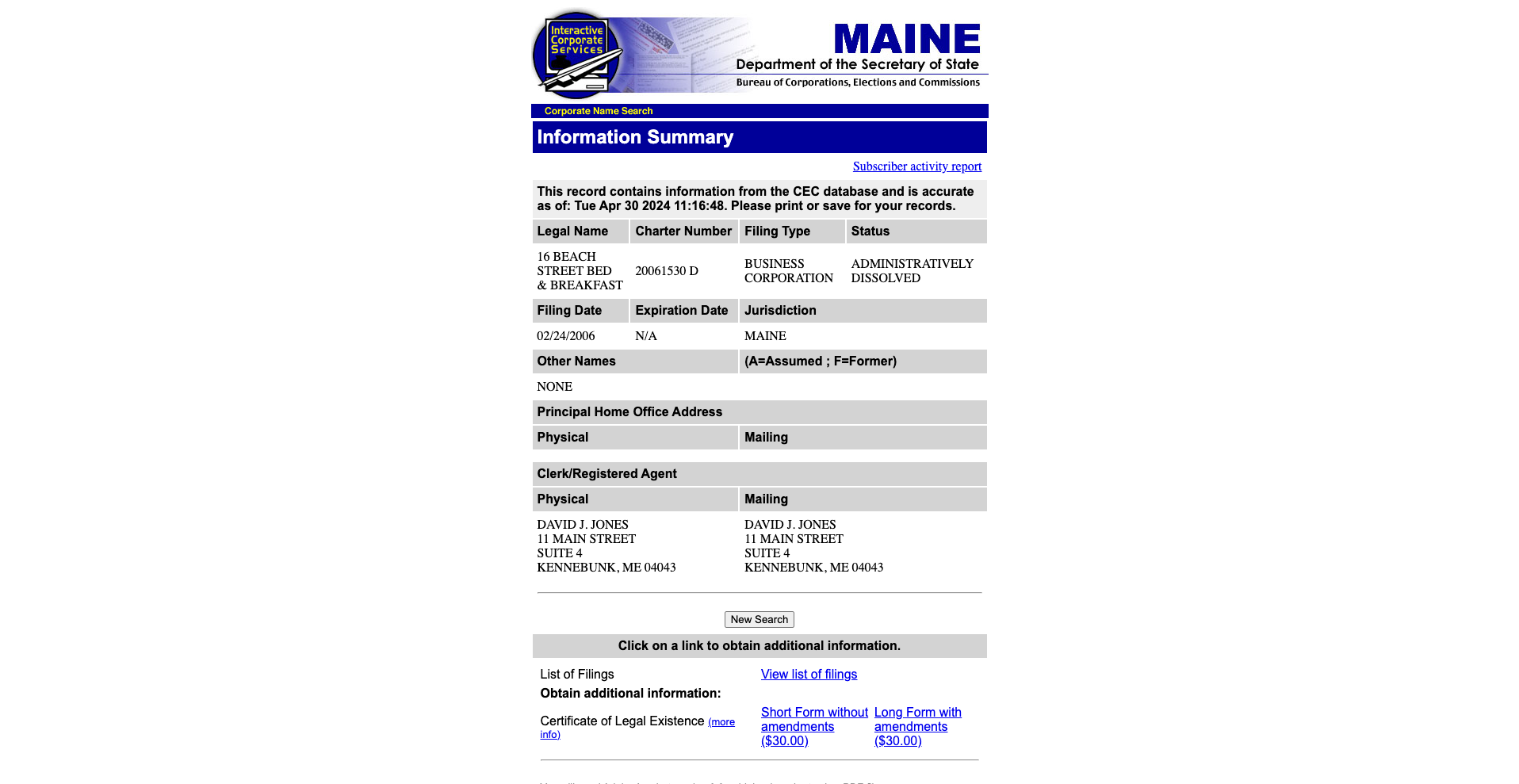

Each registered business in Maine is assigned a unique charter number, which can also be used to perform searches. This specific method is particularly useful if you have the charter number at hand, as it allows you to quickly navigate directly to a detailed summary page for the selected business.

Reserving a Business Name

Before forming a new business, potential owners have the opportunity to reserve a desired business name for up to 120 days. This process is conducted via the Maine name reservation form available on the Secretary of State's website and requires a filing fee of $50. Reserving your business name early can prevent others from registering it during your business planning phase.

Registering New Businesses and Expedited Services

For entrepreneurs ready to register a new LLC, the standard filing fee is $175. The Maine Secretary of State also offers expedited processing options for additional fees, which can reduce the processing time greatly. Under normal circumstances, processing can take up to 30 business days, but with expedited services, it can be reduced to next-day or even same-day processing, depending on the service chosen.

Additional Information for Foreign Entities

Foreign businesses that wish to operate in Maine must file a Statement of Foreign Qualification to Conduct Activities, accompanied by appropriate documentation from their home state, such as a certificate of good standing. The filing for a Maine Foreign LLC is priced at $250. This step is important for ensuring that foreign entities are legally recognized and permitted to conduct business within the state.

Accessing Additional Corporate Services

The Maine Secretary of State's website extends beyond basic search functions. It includes various interactive services such as access to necessary forms and fee structures, commercial clerk and registered agent searches, and reminders about filing requirements. The site also delineates the specific rules governing limited liability companies and the procedures for utilizing expedited service options.

Process and Fees for Forming an LLC in Maine

Individuals looking to establish an LLC in Maine are required to file a Certificate of Formation along with a fee of $175. This certificate marks the legal establishment of the LLC in the state. After formation, LLCs must continue to meet state requirements, including the submission of an annual report, which involves an $85 fee. These fees and requirements are vital for keeping the LLC in good standing with the state.

Annual Compliance and Reporting for Corporations

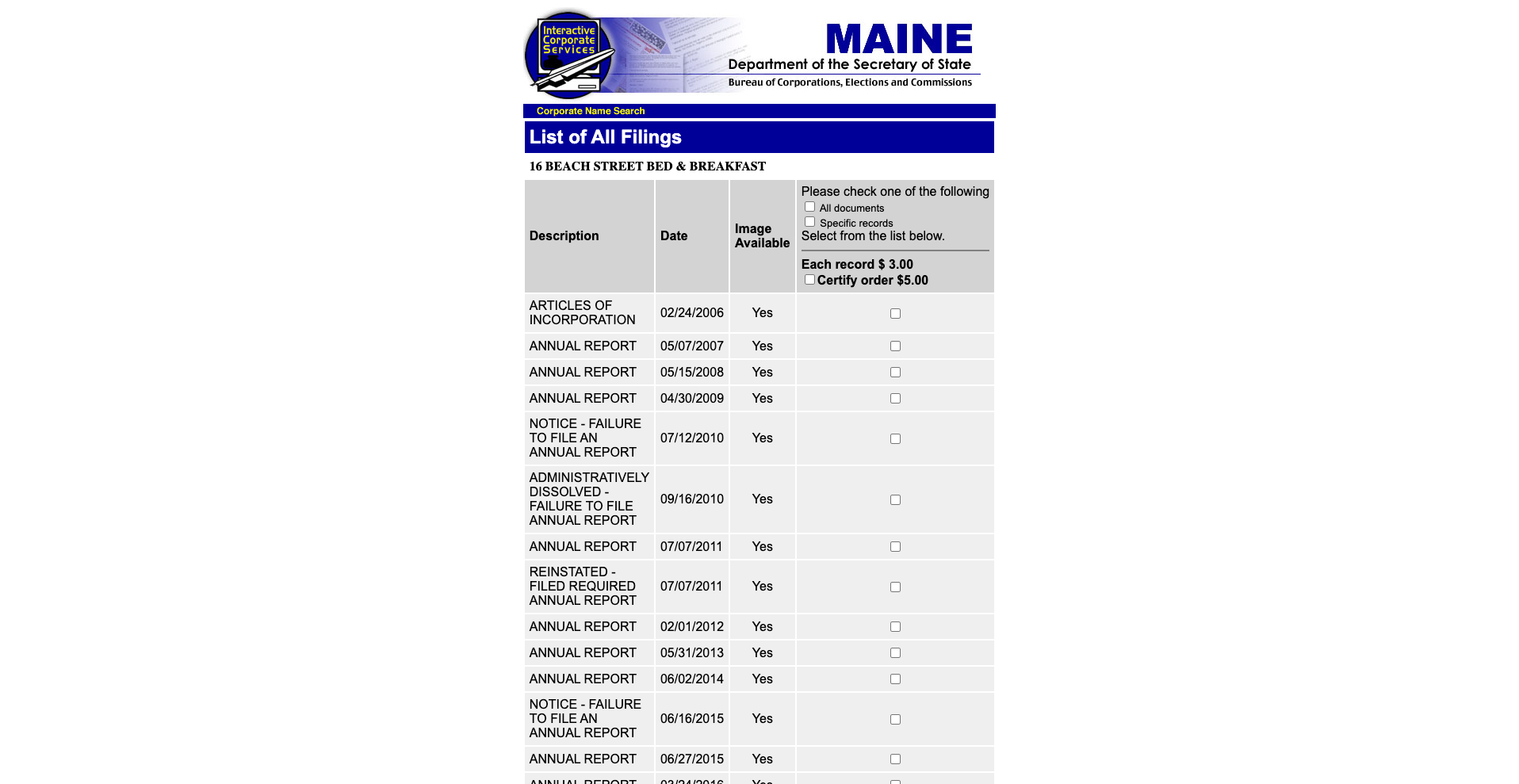

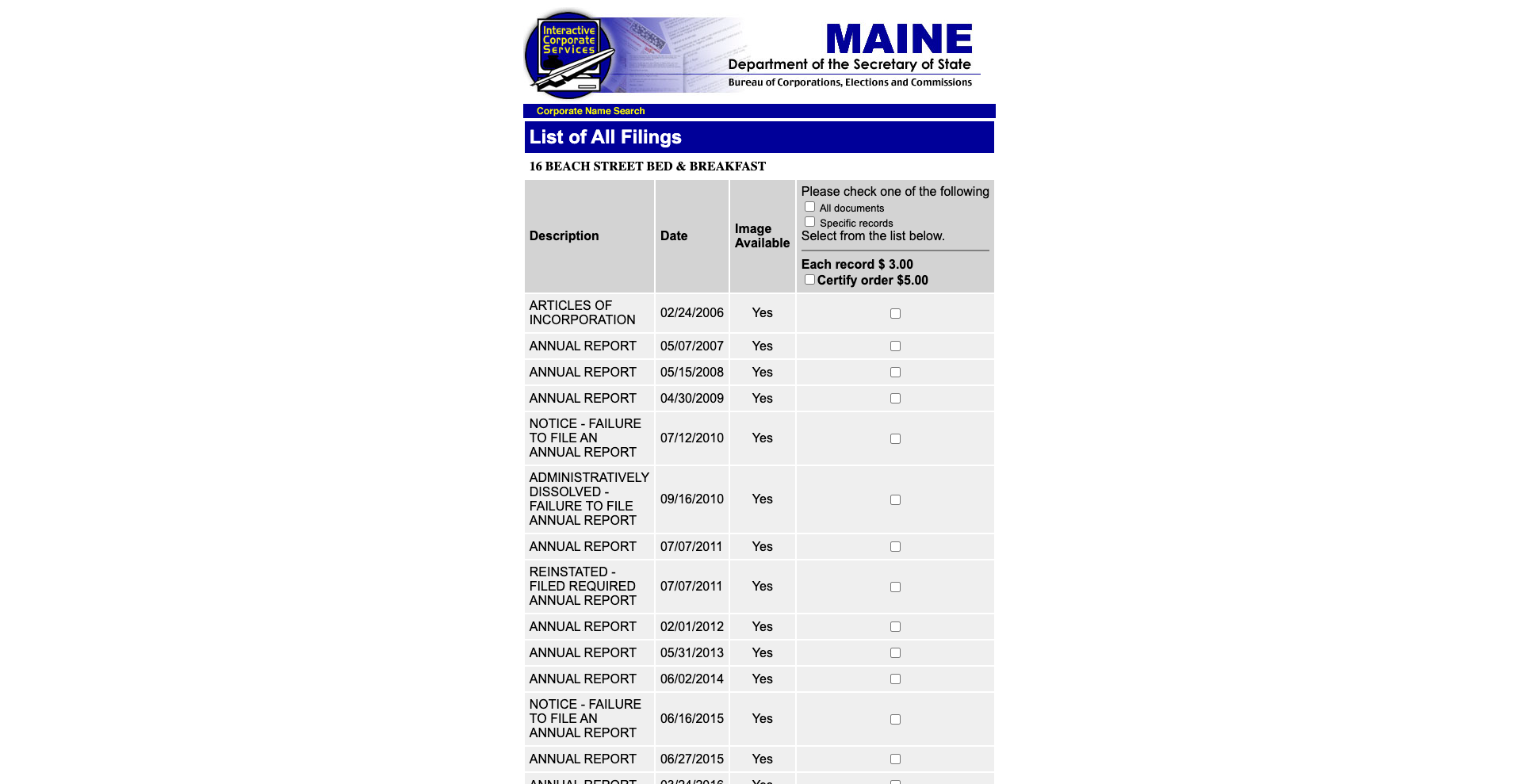

Corporations in Maine have specific annual obligations, including the submission of an annual report by June 1st, accompanied by a fee of $85. This report ensures that the corporation's information is current and correct in state records, a necessary step for compliance and corporate governance.

Business Name Reservation and DBA Registration

To secure a business name for future use, Maine allows individuals to reserve a name for up to 120 days for a $20 fee. For businesses operating under a name different from their registered legal name, a "Doing Business As" (DBA) must be filed, with the fee varying by location. This process allows businesses to operate publicly under a chosen name that differs from their formal registration.

Utilizing the Maine QuickStart Platform for Business Filings

The Maine QuickStart platform facilitates the electronic submission of various business registration documents. This system enhances the efficiency and convenience of filing, making it easier for businesses to meet state requirements without the need for in-person submissions or paper-based processes.

Requirements for Foreign Businesses Operating in Maine

Foreign entities intending to operate in Maine must file a foreign qualification and provide a certificate of good standing from their original jurisdiction. This filing carries a fee of $250 and is essential for these entities to be legally recognized and allowed to conduct business within the state.

Additional Services and Information Available

The Maine Secretary of State's office provides numerous other services related to business operations. These include the ability to file amendments, dissolutions, and to obtain certificates of good standing for a fee of $30. The office also adheres to the Corporate Transparency Act, requiring detailed reporting of beneficial ownership to combat financial crimes. This comprehensive approach ensures businesses can fully comply with both state and federal regulations.