Wyoming Secretary of State Business Search (WY Entity Search)

If you're starting a business in Wyoming or need support for your current WY entity, learn how to use the Wyoming Secretary of State Business Search portal.

Access the Search Page

Begin by navigating to the Wyoming Business Entity Search page. This page is essential for initiating your search and can be accessed via this link: https://wyobiz.wyo.gov/Business/FilingSearch.aspx. It serves as the central hub for all business entity searches within the state's database, providing a user-friendly interface for your queries.

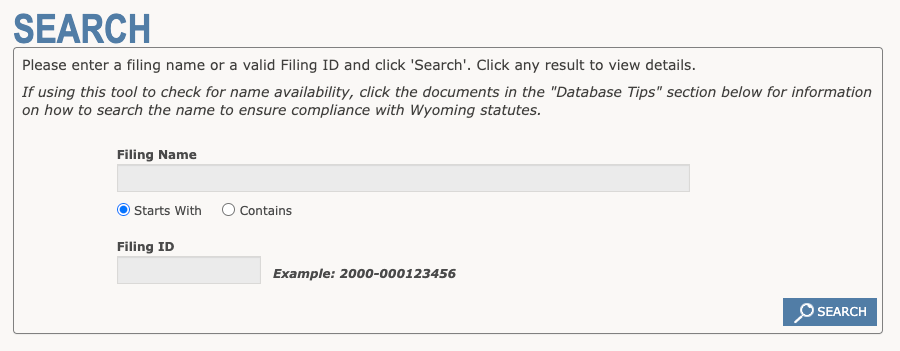

Define the Search Criteria

To define the search criteria, you have two primary options. The first is to search by name, where you can enter either the exact name or a partial name of the business entity you are looking for. The search engine is designed to be case-insensitive and will ignore special characters, spaces, and punctuation marks, which allows for greater flexibility and accuracy in matching your input with the registered entities.

The second option is to search by Filing ID. If you have the specific Filing ID number for the business entity, you can enter this unique identifier in the appropriate field. This method is particularly efficient for quickly locating a specific entity without the need to sift through multiple search results.

Conduct the Search

After you have entered your search criteria, the next step is to conduct the search by clicking the "Search" button. This action will prompt the system to process your input and generate a list of entities that match the criteria you have provided. The search results will then be displayed for your review.

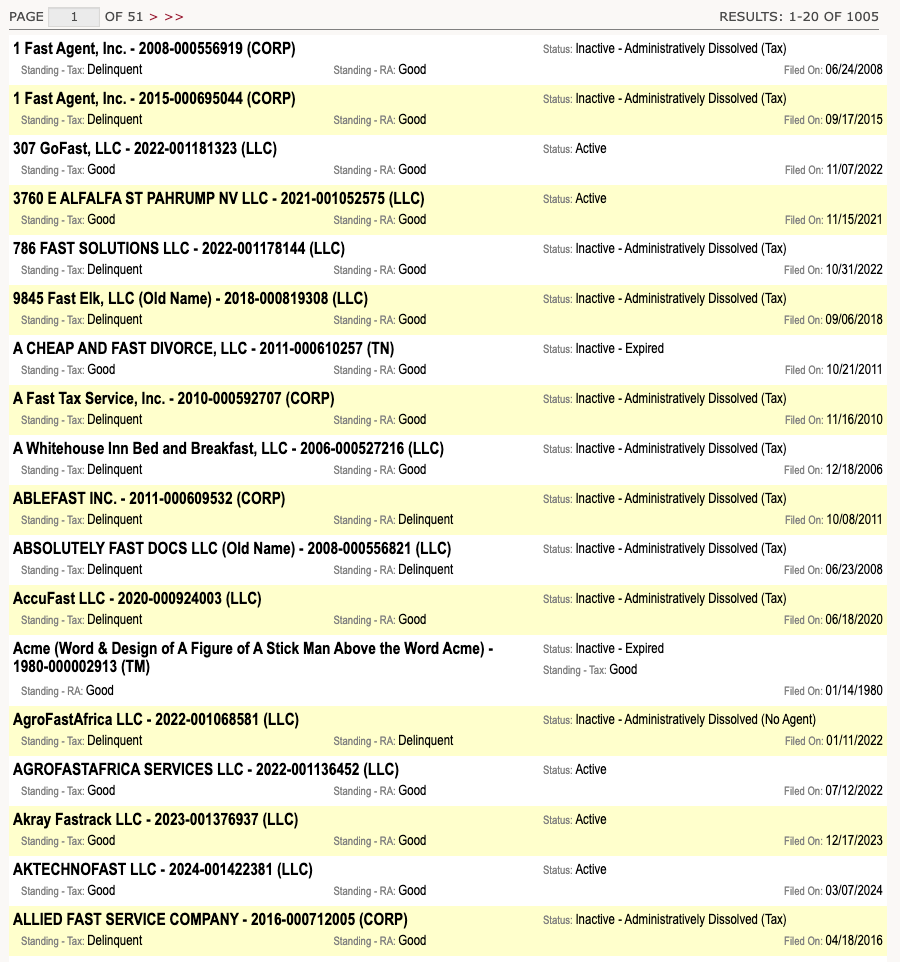

Review the Results

Once the search results are generated, they will be presented in a table format. This table includes several columns such as Name, ID Number, Status, Standing – Tax, Standing – RA, and Filed On. These columns provide a summary of the key details for each entity. To view more detailed information about a particular business entity, you can click on the entity's name within the table.

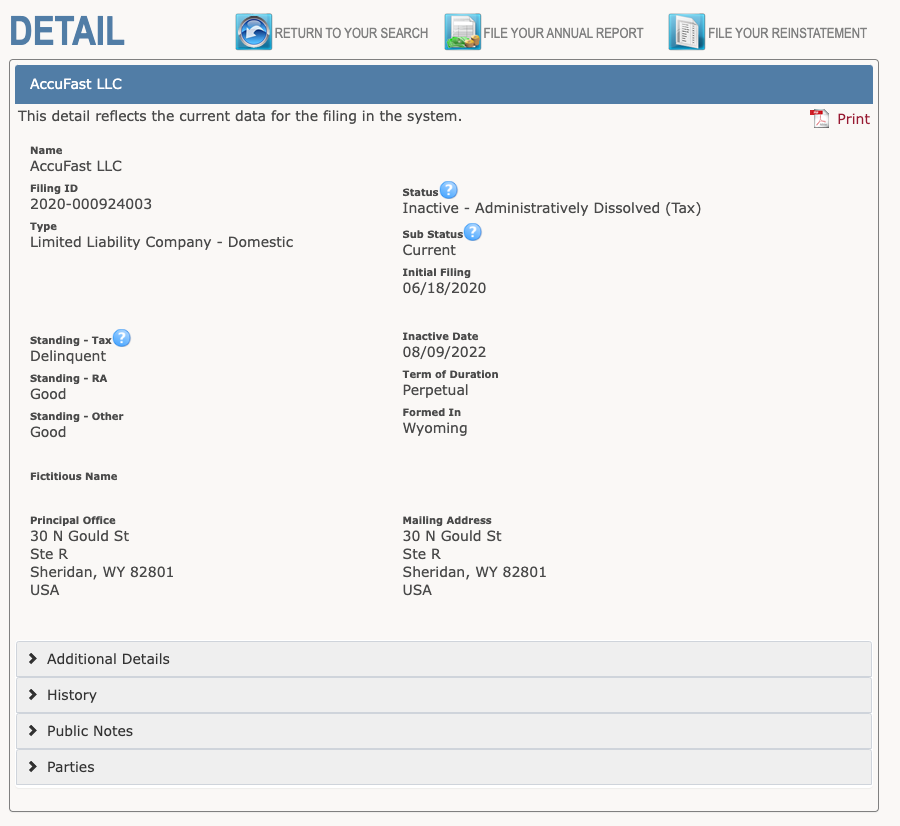

Examine the Entity Details

Upon selecting a business entity from the search results, you will be directed to a detailed information page. This page provides comprehensive data about the entity, including its Name, Filing ID, Type, Status, Sub Status, Initial Filing date, Standing – Tax, Standing – RA, Inactive Date, Term Of Duration, Formed In state, Fictitious Name (if applicable), Principal Office location, and Mailing Address. This detailed information can be important for understanding the full context of the business entity's registration and current standing.

Explore Additional Information

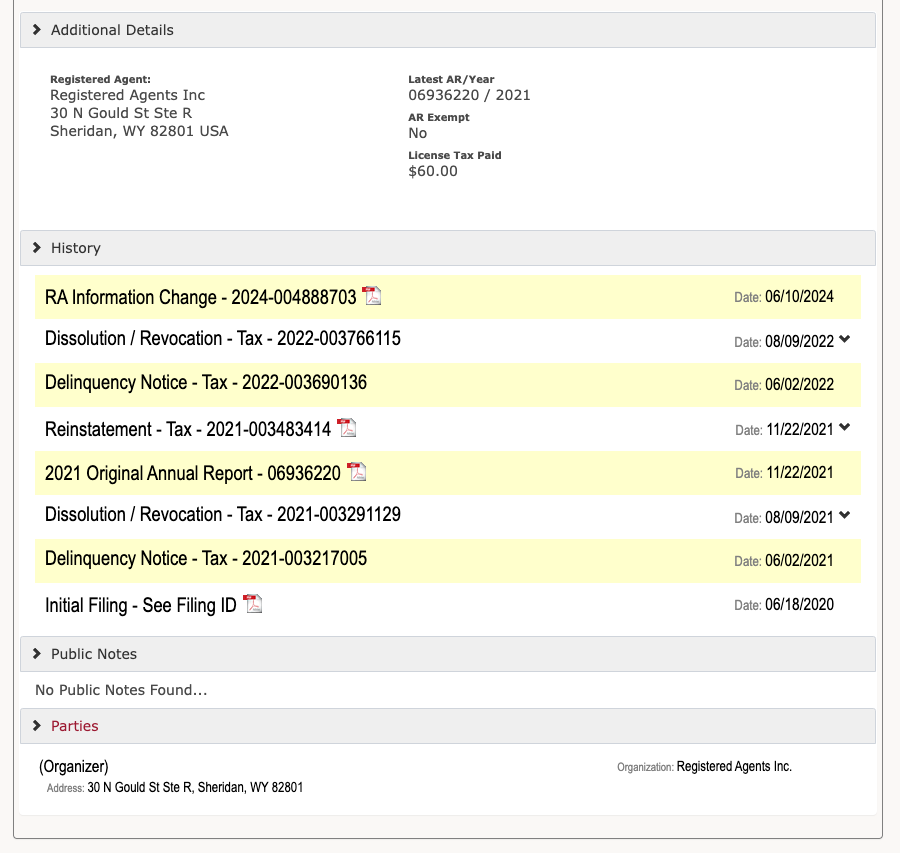

At the bottom of the entity details page, there are additional tabs that provide further information about the business entity. These tabs include Additional Details, History, Public Notes, and Parties. Each tab contains specific data that can help you gain a deeper understanding of the business entity's background, historical filings, public notes related to the entity, and the parties involved with the entity.

Tips for Effective Search

To enhance the effectiveness of your search, make use of the "Database Tips" section available on the search page. This section offers guidance on how to perform more precise and efficient searches based on specific criteria. Additionally, it is important to note the scope of the search results. The information retrieved reflects data filed with the Wyoming Secretary of State and may not include details such as ownership structure or financial data. By following these steps, you can efficiently search for and obtain detailed information about business entities registered in Wyoming.

Rules for Choosing a Business Name in Wyoming

When selecting a business name in Wyoming, it is essential to ensure that the name is distinguishable from existing registered entities. The following guidelines outline the key considerations and requirements:

Distinguishable Words and Characters

A business name must be unique and distinguishable from other registered names. The following elements are not considered distinguishable:

- Singular vs. plural forms (e.g., "Property" vs. "Properties")

- Punctuation and special characters (e.g., "XYZ Inc." vs. "X.Y.Z. LLC")

- Common words and abbreviations (e.g., "Company" or "Co.")

To check for name availability, focus on the distinguishable words and characters, disregarding the elements listed above. For example, "XYZ Inc." and "XYZ LLC" are considered the same for registration purposes.

Name Requirements for Different Entity Types

Specific entity types have distinct naming requirements. For instance:

- Limited Liability Companies (LLCs): The name must include "LLC" or a variation such as "Limited Liability Company," "Ltd. Liability Co.," or "LC."

- Corporations: While it is not mandatory, the name may include "Inc." or "Corporation."

- **Limited Partnerships (LPs) **: The name must include "Limited Partnership" or "LP."

- Statutory Trusts and Foundations: Must follow specific naming conventions as outlined in their respective statutes.

Adding Distinguishable Elements

If a chosen name is not initially distinguishable, adding unique elements can make it acceptable. Examples include:

- Adding numerals or Roman numerals (e.g., "XYZ 2 LLC," "XYZ III LLC")

- Including additional words (e.g., "XYZ Ranch LLC")

- Changing capitalization does not make a name distinguishable (e.g., "Jack" vs. "jack").

Special Considerations

Certain words and names require additional review and cannot be filed online. These include terms associated with education, banking, and trust companies. Examples include:

- Academy, College, School, University

- Bank, Banker, Bancorp, Banque

- Trust, Private Trust Company (PTC)

Names containing these words must be submitted via paper forms and may undergo an approval process by relevant state departments, potentially delaying registration.

Responsibility of the Filer

It is the filer's responsibility to ensure that the business name is distinguishable. If a non-distinguishable name is used, additional paperwork and fees may be necessary to correct the issue.

How to Find or Be a Registered Agent in Wyoming

All business entities in Wyoming must have a registered agent to accept service of process. The agent can be an individual resident of Wyoming or a business entity authorized to transact business in the state, provided they have a physical Wyoming address. Individuals must be at least 18 years old and reside in Wyoming. A "Consent to Appointment by Registered Agent" form must be signed by the agent and submitted with new entity filings. Registered agents receive legal documents if the business is sued and must maintain certain company information at their address. If you do not qualify, a roster of commercial registered agents is available on the Wyoming Secretary of State's website. To change a registered agent, submit the "Appointment of New Registered Agent and Office" form with the required fee.

How to Create a Wyoming Company or Business

Creating a business in Wyoming involves several essential steps. First, choose the type of entity you wish to form, such as an LLC, Corporation, or Sole Proprietorship. Each entity type has specific advantages and requirements. Next, select a company name and verify its availability to ensure compliance with Wyoming naming regulations.

- You must appoint a registered agent with a physical address in Wyoming to accept service of process. This can be an individual or a business entity authorized to operate in Wyoming.

- Complete the appropriate forms for your chosen entity type. Wyoming offers the option to file online for Domestic Profit and Nonprofit Corporations, Domestic Limited Liability Companies, and Domestic Limited Partnerships. Paper forms are available on the Secretary of State's website.

- The filing fee is generally $100 for most entities and $50 for Nonprofit Corporations. Online filings incur a $2.00 convenience fee. Payment for paper filings can be made via check or money order, while online filings accept Visa or MasterCard.

- Processing times vary: paper filings are processed within 15 business days, while online filings are activated immediately upon completion. After filing, you will receive confirmation via email for paper filings or immediate downloads for online filings.

- Maintain your business entity by submitting annual reports on the anniversary month of your filing. These reports update contact information and may require details on Wyoming-based assets and officer information.

For additional information, contact the Department of Revenue for sales tax, the Department of Workforce Services for workers' compensation and unemployment insurance, and the IRS for tax identification numbers.