Iowa Secretary of State Business Search

If you're starting a business in Iowa, conducting an Iowa Secretary of State Business Search if the first step. Learn how to do it with BrandSnag.

Iowa Secretary of State Business Search

Iowa's small businesses are making a major impact on the state's economy, with 9,177 new business openings and employment for approximately 639,000 individuals, contributing a net increase of 26,905 jobs. The Iowa Business Council's first-quarter Economic Outlook Survey for 2024 projects a positive six-month outlook, with an overall economic outlook index of 63.16. This optimism among business leaders regarding sales, capital spending, and employment highlights a robust and promising business climate in Iowa.

How to Conduct an Iowa Secretary of State Business Search

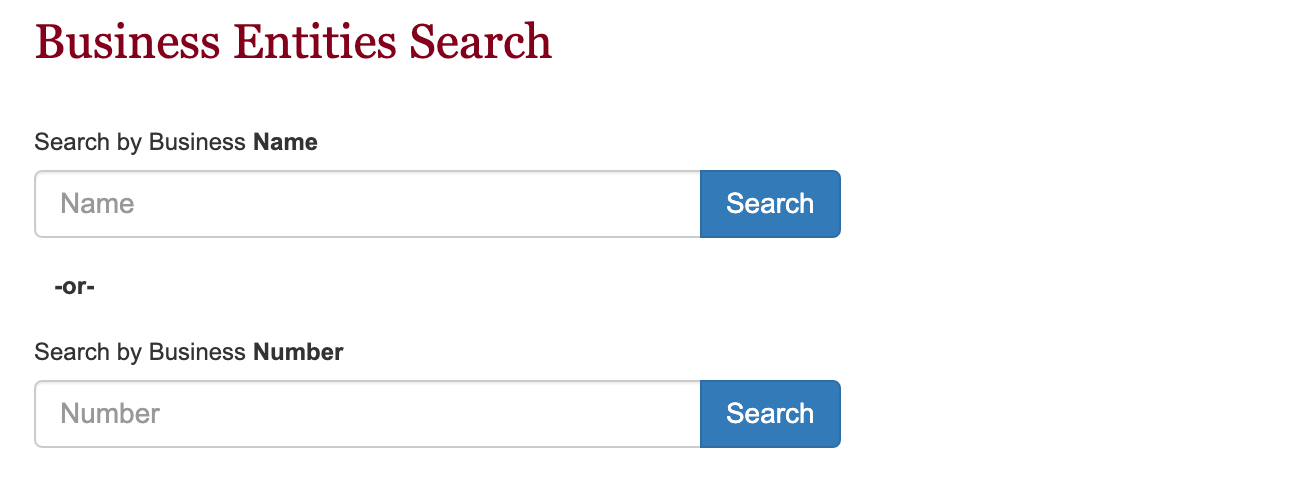

Access the Search Tool

Navigate to the Iowa Secretary of State's website and locate the Business Search tool.

Choose Search Criteria

Decide whether to search by business name or business number. The business number is a six-digit code assigned to each business.

Enter Search Information

- By Business Name: Input the business name. The search is case-insensitive and doesn't require special characters or punctuation. Partial names are acceptable.

- By Business Number: Enter the six-digit business number.

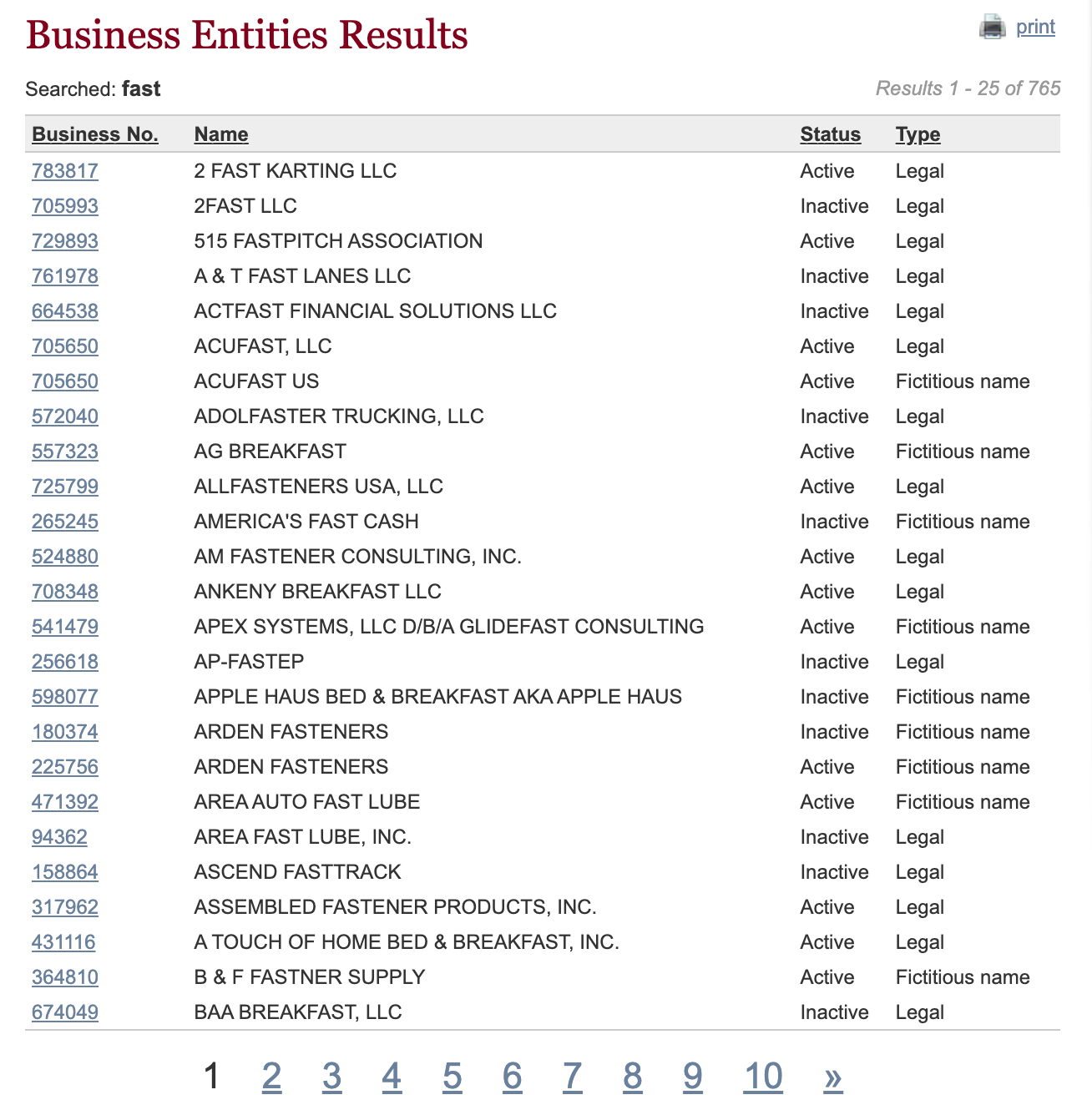

Review Search Results

The search results will show a list of businesses with their business number, name, status, and type. Click on a business number for more details.

Access Detailed Information

On the detailed information page, you will find the business's legal name, status, type, state of incorporation, expiration date, filing date, registered agent information, and home office details. Additional links may provide further information about the business, including addresses, agents, filings, names, officers, and stock details.

Additional Tips

- Name Availability: Ensure the business name you want is not already in use. Check for similar names to avoid conflicts.

- Trademark Search: Use the Trademark Electronic Search System (TESS) to check for any existing trademarks on the business name.

- Certified Copies: Obtain certified copies of business documents if needed. These can include Certificates of Formation, Corporate Dissolution forms, Certificates of Authority, and D.B.A. filings.

Contact Information

For further assistance, contact the Iowa Secretary of State:

- Address: First Floor, Lucas Building, 321 E. 12th St., Des Moines, IA 50319

- Phone: 515-281-5204

- Email: sos@sos.iowa.gov

Starting a Business in Iowa: Key Insights

Iowa's Business Landscape

Iowa hosts 272,555 small businesses, making up 99.3% of all businesses in the state. These businesses employ around 649,796 people, which is 48% of the state's workforce. In 2022, a record-breaking 33,331 new businesses were registered.

Fast Track Filing System

In 2018, Secretary of State Paul Pate introduced the Fast Track Filing system. This innovation speeds up the registration process, providing same-day service for 90% of new business filings. It has contributed immensely to the increase in business registrations, even during economic challenges like rising inflation and supply chain issues.

Tax Environment

Iowa's tax policies influence its business climate. The state has the sixth worst business tax climate and the ninth highest individual income tax rate in the nation. Despite this, Iowa does not impose a franchise tax or business privilege tax, which can benefit small business owners. The corporate income tax ranges from 6% to 12%, depending on the income bracket. Additionally, the state applies a destination-based sales tax.

Workplace Safety and Insurance

Workplace safety in Iowa is regulated by the Iowa State Occupational Safety and Health Administration. Compliance involves adhering to specific rules and providing employee training to prevent accidents. Businesses must also secure necessary insurance, including General Liability Insurance, Workers' Compensation Insurance, and Commercial Auto Insurance, to protect against various risks.

Licensing Requirements

Licensing in Iowa depends on the industry and location. There is no general business license; businesses need specific licenses, permits, and certifications relevant to their operations. Registration with the Iowa Secretary of State and tax authorities is usually required.

Economic Outlook

The Iowa Business Council's Economic Outlook Survey for 2024 indicates a positive economic trend, with an overall index of 63.16. Sales and employment expectations have increased, though workforce attraction and retention remain important concerns, alongside inflation and an unfavorable business climate.

Industry Diversity

Iowa's small businesses span various sectors, including construction, retail trade, real estate, professional services, healthcare, and administrative services. Manufacturing is the largest industry, employing 16% of the workforce.

How to Start a Business in Iowa

Choose a Business Structure

Decide on the type of business entity that best suits your needs. Here are the primary options:

- Sole Proprietorship: This is the simplest form of business structure, where the business is owned and operated by a single individual. It's easy to set up and offers complete control, but the owner is personally liable for all business debts and obligations.

- General Partnership: This structure is similar to a sole proprietorship but involves two or more people. Partners share profits, losses, and management duties. Like sole proprietorships, partners are personally liable for business debts.

- Limited Liability Company (L.L.C.): An L.L.C. combines the benefits of a corporation and a partnership. It offers liability protection to its owners (members) while allowing flexible tax options. Members are not personally liable for business debts.

- Corporation: This is a more complex structure, ideal for larger businesses. Corporations provide liability protection to their shareholders and can raise capital through stock sales. However, they require more extensive record-keeping, operational processes, and reporting.

Register Your Business Name

Choosing and registering your business name is an important step:

- L.L.C. and Corporations: The name must include "L.L.C.," "L.L.C.," "L.C.," or "L.C." for limited liability companies, and appropriate designations for corporations. This ensures that the public can easily identify the nature of your business.

- Trade Name: If you are a sole proprietor or in a partnership and plan to operate under a name different from your legal name, you must file a trade name with the county recorder. This process helps protect your business name and avoid legal issues with other businesses.

Hire a Registered Agent

For L.L.C.s and Corporations, appointing a registered agent is mandatory:

- Registered Agent: This person or business entity will receive legal documents and official notices on behalf of your business. The agent must be a resident of Iowa or a business entity authorized to conduct business in Iowa. Having a reliable registered agent ensures that you do not miss important legal and tax documents.

File Formation Documents

To legally establish your business entity, you need to file specific documents with the Iowa Secretary of State:

- L.L.C.: File a Certificate of Organization. This document includes essential details like the L.L.C.'s name, address, and information about its registered agent. The filing fee is $50.

- Corporation: File Articles of Incorporation, which outline the corporation's basic information, such as its name, address, purpose, and details of its registered agent. The filing fee is also $50. These documents are important as they formalize your business structure and provide it with legal recognition.

Obtain an Employer Identification Number (E.I.N.)

An E.I.N. is a federal tax identification number required for most businesses:

- E.I.N.: If your business has employees or multiple members, you need to obtain an E.I.N. from the I.R.S. This number is used for tax purposes and is necessary for opening a business bank account, hiring employees, and filing taxes. The application process is straightforward and can be completed online for free.

Register for State Taxes

Depending on your business activities, you may need to register for various state taxes:

- Sales and Use Tax Permit: If your business sells tangible goods or taxable services, you must register with the Iowa Department of Revenue to collect and remit sales tax. This ensures compliance with state tax laws.

- Withholding Tax: If you have employees, you need to register for withholding tax to remit state income tax withheld from your employees' wages. This is essential for meeting your payroll tax obligations.

Obtain Necessary Licenses and Permits

Your business may require specific licenses and permits to operate legally:

- Professional Licenses: Certain professions, such as accountants and real estate brokers, require state-specific licenses. Ensure you meet all requirements and obtain the necessary credentials.

- Special Licenses: If your business involves selling alcohol, tobacco, or handling hazardous materials, you need to obtain special licenses and permits. These regulations ensure public safety and compliance with state laws.

File Biennial Reports

To maintain your business's good standing, you must file regular reports:

- Biennial Reports: Both L.L.C.s and Corporations are required to file biennial reports with the Iowa Secretary of State. These reports update the state on essential information about your business. The fee is $60 for mail filings and $45 for online filings. Timely filing of these reports helps avoid penalties and keeps your business in compliance.

Comply with Zoning Laws

Ensure that your business location adheres to local zoning regulations:

- Zoning Laws: Before selecting a business location, check with local government or planning departments to ensure your business activities comply with zoning laws. This step helps prevent legal issues and ensures your business can operate smoothly in its chosen location.

Consider Additional Requirements

There are additional steps you may need to take, depending on your business type:

- Operating Agreement: While not required, it is recommended for L.L.C.s to create an operating agreement. This document outlines the management structure, roles, and responsibilities of members, and helps prevent disputes.

- Insurance: Obtain necessary business insurance, including general liability insurance and workers' compensation if you have employees. This protects your business from various risks and ensures compliance with state regulations.

Utilize Available Resources

Take advantage of the resources and support available to small businesses in Iowa:

- Iowa Economic Development Authority: Offers various programs, resources, and support to help businesses grow and succeed.

- Small Business Development Centers: Provide free, confidential assistance on a range of business topics, from planning and financing to marketing and management.

- Greater Iowa City, Inc.: Provides networking and promotional opportunities, helping businesses connect with the community and other businesses.

Stay Informed on Tax Changes

Stay updated on changes to Iowa's tax laws to ensure compliance:

- Tax Changes: Iowa is transitioning to a flat income tax rate. Keeping informed about these changes will help you plan and adjust your business strategies accordingly, ensuring you remain compliant with state tax obligations.